Navigating the peaks and plateaus of the global interest rates outlook

By John Orford, Portfolio Manager, Old Mutual Investment Group

Predicting the path of inflation and interest rates has proved a chastening activity over the last two years.

The environment had clearly changed since July 2021 when US Federal Reserve Bank Chairman Jerome Powell dismissed surging US consumer prices as transitory.

By July 2023, following a further series of rate hikes, Powell insisted that the Fed “will do what it takes to get inflation down”.

Falling inflation is still higher than the target

However, in recent months, core inflation in the US and euro zone has slowed, reaching moderate levels by September.

Global interest rates appear to have scaled the peak, but they are likely to spend some time on the plateau.

The Fed, for example, has been at pains to emphasise that it expects rates to remain higher for longer.

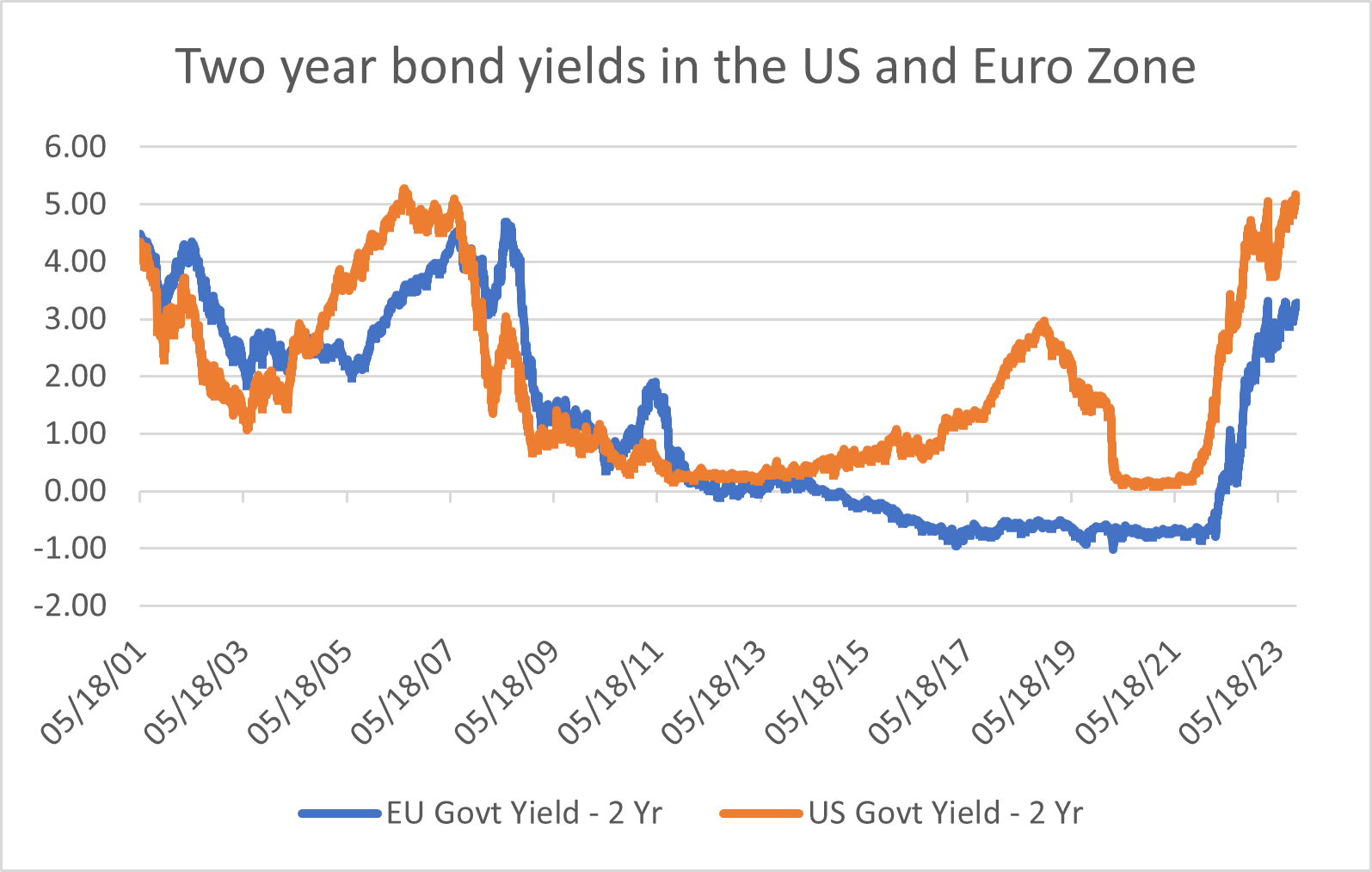

In global bond markets, the entire curve is lifting higher in both the US and Europe.

Two-year bond yields, an excellent barometer for future rate expectations, are at their highest levels since before the 2008 financial crisis, pricing in the “higher for longer” outlook.

Restrictive interest rates

There are clear risks to the near-term inflation outlook, including persistent strength in the US labour market and the recent surge in oil prices towards US$100 per barrel, but what has changed is that interest rates have reset from being excessively stimulatory to more restrictive levels.

Restrictive interest rates will be a brake on economic activity over the next year, with banks, for example, tightening their lending standards as rates have ratcheted higher.

Lending conditions at the tight levels they are at now have always resulted in a sharp contraction in lending over the following year, and we see no reason why that should be different this time round.

The US labour market has, of course, been a visible sign of resilience recently.

Year to date an average of 260 thousand jobs have been created every month – strong but sharply lower than 2022 and 2021.

As much higher interest rates continue to bite over the coming months, growth in the US and Europe is likely to slow, which will feed through to weaker demand and less pressure on prices.

This should pave the way for a more dovish shift among central bankers someway into 2024.

All in all, this means we are very likely close to or at the peak of the current interest rate cycle, although this does not mean central banks will pivot towards cuts imminently – inflation is still too high for that.

However, once growth slows more decisively in the US in 2024, it is not unreasonable to expect lower global rates at some point next year.

Assessing the horizon for local rates

For South Africa, restrictive monetary policy, weak growth and inflation near the mid-point of the target range already call for easier policy.

Despite these factors, immediate interest rate relief is unlikely, with the central bank remaining focused on risks to the inflation outlook, including the fiscal outlook, the currency and higher oil prices.

A peak and possible decline in global rates later in 2024, however, would ease the pressure on the currency and provide scope to implement modest rate cuts, provided inflation remains well anchored within the target range.

As we move into 2024, globally, the environment over the next year will likely favour bonds over equities, with starting yields on global bonds much higher and peaking rates supporting bond prices, while weaker growth will be challenging for equities.