Good news for petrol prices in December

Despite the rand giving up some of its gains this week, a weakening global oil price is keeping South Africa on track for another big cut to petrol and diesel prices in December.

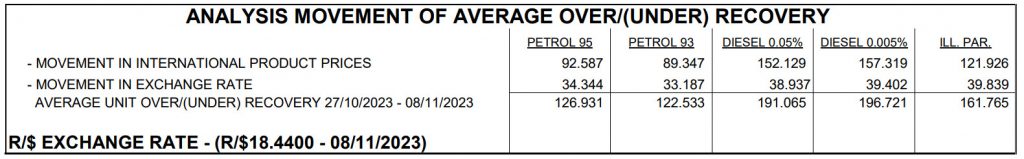

According to the latest data from the Central Energy Fund, petrol prices are showing an over-recovery (indicating a price cut) of between R1.23 and R1.27 per litre, while the wholesale prices of diesel are eyeing another cut of almost R2.00 per litre.

Both the rand and the global price of petroleum products – driven by oil – are working in motorists’ favour, though the bulk of the legwork is coming from oil.

The rand has strengthened well below R19 to the dollar since Finance Minister Enoch Godongwana tabled a distressing but palatable medium-term budget at the start of the month.

While the rand strength was initially misattributed to markets finding the National Treasury’s plan to tackle the widening budget deficit as credible, it became evident later in the week that the local unit’s movements had little to do with local events.

Instead, the rand strengthened on a softer dollar as the US Fed held on rates, leading to a risk-on environment. Some of these gains reversed this week as the dollar recovered from a sell-off and markets brace for monetary policy commentary from the Fed.

Even though the rand is slightly weaker, on Thursday (9 November), it was still trading below the R19/$ levels it had been restrained to in October, so conditions are relatively better for the local currency.

Oil recedes

The big winner for local fuel prices, however, is the lower oil price, which has dropped below the $80 a barrel mark.

Oil prices flared up in October after the war between Hamas and Israel escalated in the early weeks of that month, threatening to bring in neighbouring Middle Eastern countries like Iran and Saudi Arabia into the conflict.

Market fears over these major oil-producers getting pulled into a long-term conflict put pressure on oil supply projections and sent the spot price shooting to over $95 a barrel.

However, Bloomberg analysis shows that the concerns over supply have given way to realities of much lower demand, effectively snuffing out talk of oil prices rallying to over $100 barrel as many had expected this year.

“The benchmark retreated to a three-month low under $80 a barrel. Concerns about supply are giving way to doubts about plunging refinery profits in China and Europe, lacklustre physical cargo trading and an uncertain economic outlook for the US,” the group said.

“The market seems to be shifting its focus from fear-driven geopolitics to hard-fact fundamentals. Ample supplies, incremental production growth, and stagnating demand create an overall soft fundamental backdrop.”

However, the group cautioned that not all forecasters expect the lull to last – with some analysts like Goldman Sachs, Standard Chartered and Barclays still seeing scope for crude to pick up again as further increases in demand whittle away stockpiles.

For now, however, the prospects for local fuel prices looks good, with a substantial turn in both the oil price and rand required to negate the potential price cut.

Read: This ‘tax alternative’ could end the fuel levy and cut petrol prices in South Africa