Hope for South Africa’s property market – but storm clouds are gathering

Estate agents are optimistic about the future of South Africa’s property market, but expectations that interest rates will be put on hold may be naive.

According to the latest FNB Estate Agents Survey, market activity moved sideways to a rating of 5.1 out of 10 in Q3 2023 – below the long-term average of 5.9 and far lower than the 7.1 peak in Q4 2020.

“Compared to Q4 2021, at the onset of the current interest rate hiking cycle, mortgage transactions have declined by approximately 24%,” FNB said.

That said, the decline in activity has been relatively shallow compared to the global financial crisis.

Moreover, agent expectations for the housing market showed some optimism in Q3 2023, with 50% (Q2 2023: 17%) of respondents stating that they expect an increase in activity over the next three months.

“Factors cited for this optimism include expectations that interest rates have peaked as well as the customary increase in activity during the summer months. Less severe load shedding in recent months has also boosted sentiment in the market,” FNB said.

The results also showed that the average time on the market for properties dropped from 85 days in Q2 2023 to 82 days in Q3 2023, with less severe load shedding likely leading to this progress.

Although the percentage of properties that take three months to sell has increased from 33% in Q1 2022 to 67% in Q3 2023, future expectations are far better due to a decline in the severity of load shedding and expectations that interest rates have hit their peak.

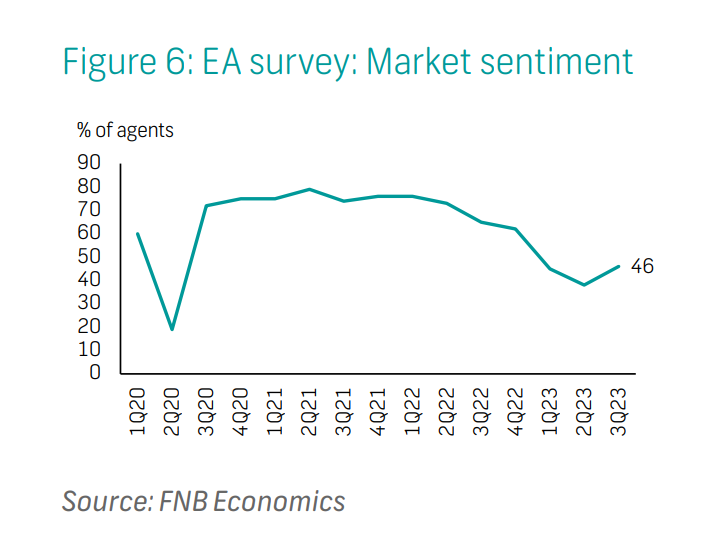

Thus, the proportion of real taste agents who are satisfied with the current market conditions grew from 38% in Q2 2023 to 46% in Q3 2023. Although this still reflects mainly weak market enthusiasm, it is still an improvement.

Interest rate pain

However, the expectation that interest rates have reached their plateau may be too optimistic.

“We expect that interest rates have reached their peak, with a measured cutting cycle coming into view in the latter half of 2024,” FNB said.

“However, the short-term prospects for this forecast carry an upside risk, particularly if upward pressure on food and fuel prices intensifies, and government fiscal position deteriorates.”

Bank of America economists Tatonga Rusike and Mikhail Liluashvili and the Bureau for Economic Research (BER) said that the South African Reserve Banks (SARB’s) Monetary Policy Committee (MPC) will likely raise interest rates when it meets again next month.

“Higher oil prices and an outbreak of bird flu – leading to shortages of poultry products – will likely raise food prices in the near future,” Rusike and Liluashvili said.

“Oil prices are also close to $90 per barrel, while USD/ZAR is weakening near term. A strong USD to year-end means a weaker ZAR as global interest rates are set to stay higher for longer. Near-term fiscal risks are likely concerning for the SARB as well.”

“The South African Reserve Bank (SARB) is likely to hike rates by another 25 basis points at the November MPC before initiating cuts in the second quarter of 2024.” This would take the repo rate to 8.50%.

SARB Deputy Governor Fundi Tshazibana also said that there are far too many risks to the inflation outlook to certainly say that the interest rate hiking cycle has hit its peak.

“While many in the public domain are trying to get us to say the hiking cycle is over, as I said, there are too many risks on the horizon for us to pronounce on it,” Tshazibana said.

“We have seen recent price pressures mainly in fuel but also on the food side.”

Read: This is the busiest mall in South Africa – situated in the country’s shopping capital