Middle-class South Africans are ‘losing’ over R10,000 every month

Middle-income employees earning the average take-home pay in South Africa are over R10,000 poorer than they were in 2016, thanks to inflation and stagnant salaries.

Currently, there is no official determination of the middle class, with many researchers and economists having differing determinations in light of the diverse and significant disparity between those who have and those who do not.

The Bureau for Economic Research (BER), in its latest report on consumer confidence, regarded a household with earnings of between R5,000 and R20,000 per month as a middle-income household.

BER regarded households with monthly earnings above R20,000 as high-income households.

Research and analytics firm Eighty20, in its latest Credit Stress Report, defined middle-class workers as those households with an income of nearly R25,000 a month and a personal income of R15,000.

This is generally in line with BankservAfrica’s latest Take-Home Pay Index (BTPI), which shows the average take-home pay is around R15,673 per month as of September 2023, and this segment is getting hammered in South Africa.

According to the latest BankservAfrica BTPI, average nominal salaries (actual terms) rose 4.1% year-on-year in South Africa in September, but as this was below the inflation rate, in real (inflation-adjusted) terms this translated into a 0.8% drop in real take-home pay to R14,239 over the period.

Investec Chief Economist Annabel Bishop noted that households’ purchasing power has been on a general decline following on from last year’s collapse – with real take-home pay at R15,450 in January 2022, and R15,771 in February 2022.

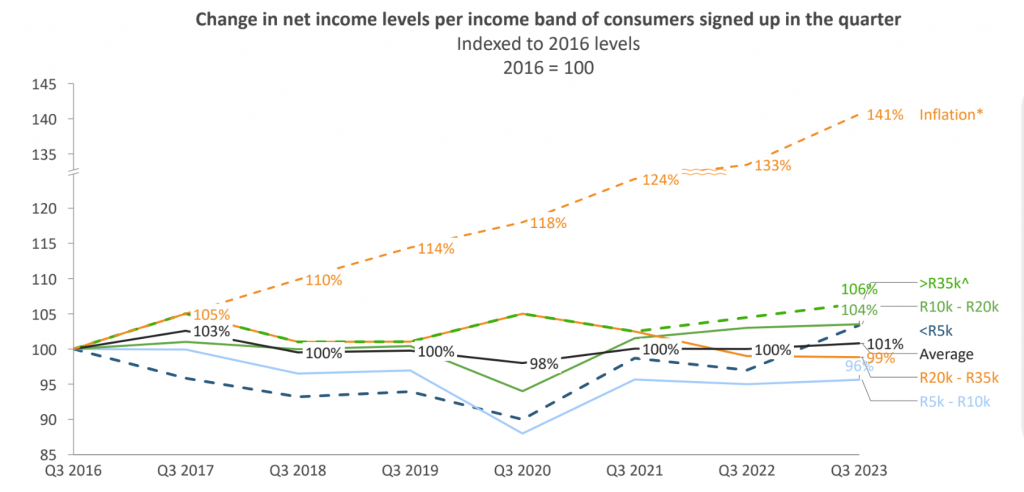

DebtBusters revealed in its Debt Index report for the third quarter of 2023 that consumers are feeling like they are taking home 40% less today in real terms than they did in 2016” as the trend of a decline in real purchasing power has persisted since 2016.

The firms’ data shows nominal incomes were 1% higher than 2016 levels; however, when cumulative inflation growth of 41% is factored in for the same seven-year period, consumers’ purchasing power diminished by 40% over this period.

This means middle-income South Africans taking home R15,673 per month should be earning roughly R26,122 today to have the same purchasing power they had in 2016 – equating to a loss of R10,449 per month.

Higher interest rates have negatively affected consumer spending too, with a substantial run-up in the prime lending rate since November 2021, of 4.75%, to 8.25% from 3.50%, which is not historically uncommon, but new borrowers in the cycle will feel additional pain, said Bishop.

According to the latest Consumer Financial Vulnerability Index (CFVI) from Momentum and Unisa, although the cyclical factors, such as high interest rates and inflation, continue to be major risks to consumer finances, two structural risks – load shedding and political instability and corruption – were major concerns for consumer finances.

When looking at Q4 2023, structural risks are expected to be the biggest issues, as the effect of cyclical factors is expected to subside.

“Persistent unemployment, poverty, and inequality and continuous load shedding are expected to be the highest risks to consumer finances in Q4 2023,” Momentum and Unisa said.

Read: How much money you need to save to retire comfortably – from ages 30 to 65