Massive pay gaps: CEOs earning up to 950 times more than the average worker in South Africa

Researchers from Wits University’s Southern Centre for Inequality Studies say that new laws coming to South Africa that will make it mandatory for companies in the country to reveal their pay gaps between highest- and lowest-paid workers will go a long way in exposing deep-rooted inequality.

The group were among many organisations, committees and other stakeholders to make presentations on the new Companies Amendment Bill to Parliament on Tuesday (17 October). The bill was tabled before parliament at the end of August by Trade and Industry Minister Ebrahim Patel.

One of the key changes introduced in the bill is to force listed companies in the country to disclose the ratio of the top-paid to the bottom-paid 5% of workers in their reporting.

According to the researchers, South Africa has historically high income and wealth inequality. They argued that disclosing wage differential would mean that companies could no longer ignore these inequalities when addressing earnings.

While the amendment bill makes no move to regulate the compensation payable to top executives – and it is important that it does not – the researchers said that disclosing the ratios would provide the companies and their shareholders with sufficient data to make informed decisions on executive pay.

High levels of executive pay have become a contentious issue the world over, but stands out in a country like South Africa where some top executives earn over R500,000 a day, compared to the average of R800 a day, or the poverty line of R25 a day.

In recent years, there has been a significant spike in shareholders of listed companies voting against high executive pay at Annual General Meetings, particularly in the finance sector.

Pay gaps

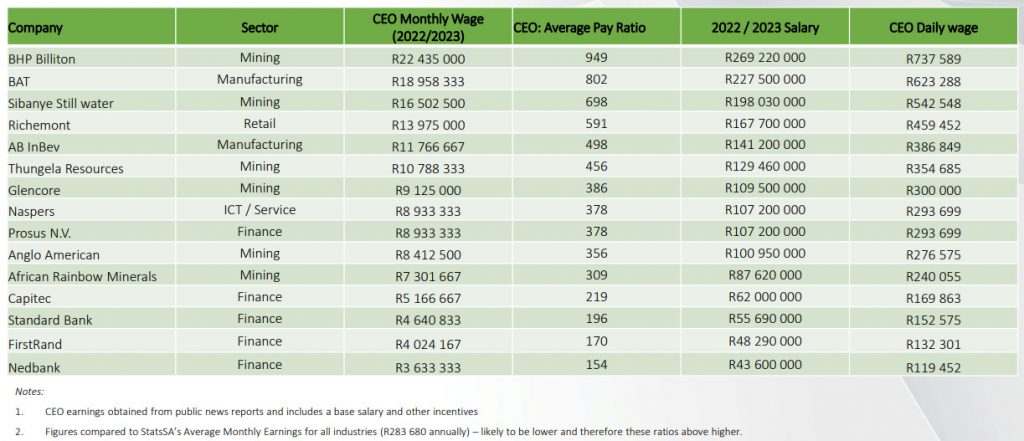

As part of their presentation, the Wits researchers provided preliminary data on pay gaps in South Africa using the executive pay of some of the biggest listed companies on the JSE.

In this analysis, the researchers used the earnings reported by the companies and weighed them against the average monthly earnings as reported by Stats SA for all industries – ie, R283,680 per year.

They noted that the lowest-earning employee at various companies may be different – and likely much lower – and as such, the pay gaps are likely to be higher than what their preliminary analysis shows.

Despite this, the data points to a massive gap, where some top-paid executives earn 200, 500, or even close to 1,000 times more than the average worker.

Broken down on a per-day basis, the highest-paid executive in the data set – BHP Billiton’s Mike Henry – was earning close to R740,000 per day, 949 times larger than the national average (R780 a day).

In terms of the new proposed laws, on top of the current remuneration reporting requirements, companies in South Africa will have to include the following in their reporting:

- The company’s remuneration policy, which must be set out in a separate part of the remuneration report;

- An implementation report containing details of remuneration and benefits received by each director or prescribed officer;

- The total remuneration – including all salary and benefits, including employer contributions to benefit funds, short-term incentives or bonuses and long-term incentives – of an employee with the highest total remuneration. This is not limited to the CEO, it can be any other executive or prescribed officer.

- The total remuneration – including all salary and benefits, including employer contributions to benefit funds and incentives or bonuses – of an employee with the lowest total remuneration in the company;

- The average remuneration of all employees, median remuneration of all employees and the remuneration gap reflecting the ratio between the total remuneration of the top 5% highest paid employees and the total remuneration of the bottom 5% lowest paid employees of the company.

The new remuneration report with all these details must be approved by the board of the company and presented to the shareholders at the annual general meeting where it must be voted on by the shareholders for approval.

The new laws don’t only focus on pay, however, they also put a spotlight on other factors like beneficial ownership of a company and cutting red tape.

The department wants to improve the ease of doing businesses in South Africa by cutting “unnecessary red tape” and making regulations clear, user friendly, consistent with well-established principles and not be over burdensome on the conduct of business.

Another major focus of the proposed laws is greater disclosure of the ultimate owners of shares in a business. This is part of the state’s wider push to combat corruption and money laundering and came as a result of the General Laws Amendment Act that was passed at the end of 2022.

By implementing the amendments, the government hopes to attract investors and also make the local economy more effective and efficient so it can create more jobs.

Read: New laws bringing big changes for businesses in South Africa – what you need to know