Calls to pay workers a ‘living wage’ of R12,000 a month in South Africa

South African employers should pay their workers a living wage and not just the national minimum prescribed by law – suggesting a pay between R12,000 to R15,000 per month at least.

This is according to Professor Ines Meyer of the Living Wage South Africa Network, who said in a world of growing calls for global social reform, companies that want to preserve their market share will have to pay their employees at least a living wage.

Announced in February 2023, the National Minimum Wage (NMW) was hiked by 9.6%, bringing it up to R25.42 per hour. This equates to R4,067 per month for a 40-hour work week.

Both globally and locally, determining an appropriate living wage is problematic due to a lack of data and inconsistency in the data that is available, but several institutes have highlighted what they consider a living wage.

For example, research partners Studies in Poverty and Inequality Institute (SPII), Labour Research Service and South African Social Policy Research Insights say that the average South African must earn R7,911 or more per month to maintain a decent standard of living (DSL).

Additionally, Economics and financial market data provider Trading Economics estimates the living wage in South Africa to be R6,700 per month for an individual and R10,630 per month for a family.

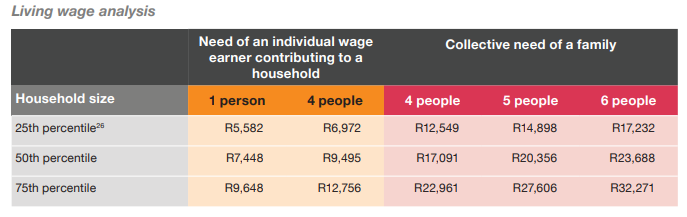

According to PwC’s estimates, data shows that a single person will need to earn anywhere between R5,582 to R9,648 per month to earn a living wage.

This figure increases to between R6,972 and R12,756 for a family of four. A family of six will need a living wage between R17,232 and R32,271.

The result is a growing body of research that pinpoints the optimal living wage organisations should adopt, which Meyers said is roughly between R12,000 and R15,000 a month. Compared to the current NMW, this effectively calls for a minimum monthly salary increase of between 195% and 269%.

Meyers noted that while companies may see such figures as an unwanted loss to their business, the World Economic Forum (WEF) has identified many overriding benefits.

Some of these benefits are:

- Retaining the patronage of consumers who favour ethical companies that share their value of an equitable world;

- Lifting workers out of poverty has been shown to grow consumer markets; and

- Companies also experience less absenteeism, greater employee engagement and increased productivity.

“Worker poverty can adversely affect the entire organisation, including profits, so early adopters of a living wage initiative stand to benefit sooner and win a greater share of the market,” added Meyers.

Bad for business

Business groups have acknowledged the hardships faced by many minimum wage earners in South Africa, and the dire economic circumstances they find themselves in could not be ignored, and the purpose of the NMW is to ensure some level of a living wage.

However, the challenging environment in South Africa has created hardships for wage earners and employers alike.

Legal experts have argued that the NMW itself – let alone a much more expensive living wage – disincentivises businesses from hiring new employees due to the cost and the stringent labour laws that often protect workers over employers.

As the wage increases, costs go up – and businesses, particularly SMEs, that can no longer afford the overheads cannot easily let workers go.

Amid record levels of unemployment in South Africa, FirstRand co-founder and former CEO Paul Harris even believes scrapping the minimum wage for anyone under 25 would have a notable impact on the country’s unemployment crisis.

“At present, people get the social grant without working, but the youth can’t enter the job market by voluntarily working for less than the minimum wage,” he said.

“The outcome of minimum wages has been more unemployment and fewer viable SMEs; they employ fewer people, and more go bust.” However, the Department of Labour said that the national minimum wage has not impacted employment levels or raised unemployment in sectors it has assessed.