Major tax squeeze coming for South Africa

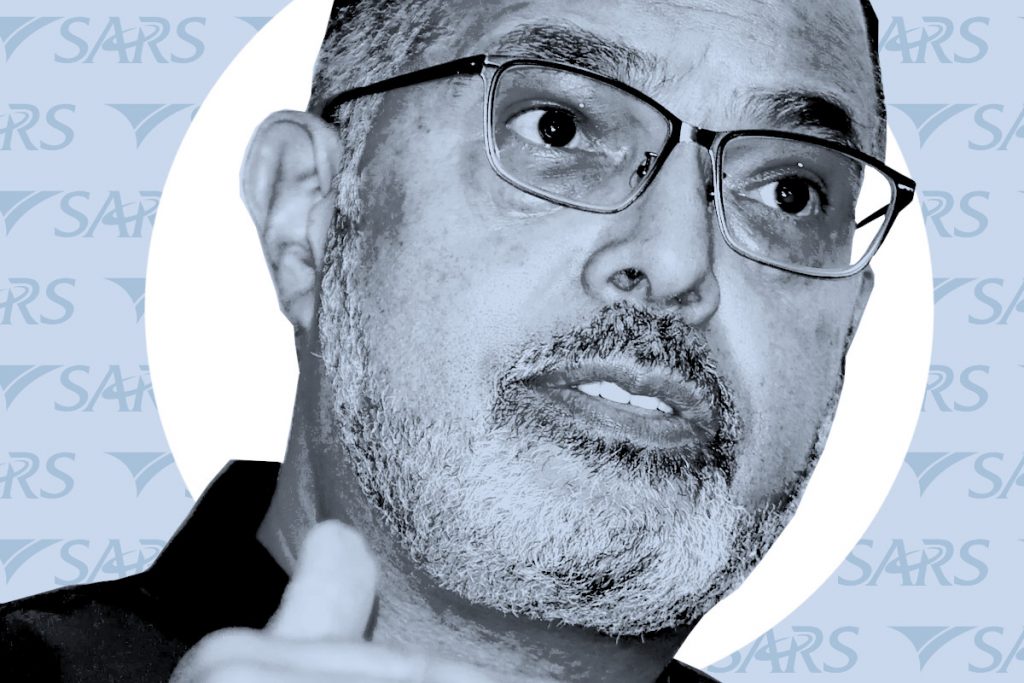

The South African Revenue Service (SARS) is set to bring a big tax squeeze to South Africans as the government scrounges around for more revenue, says Bernard Mofokeng, Tax Controversy Leader, Deloitte Africa.

This, as the country faced more bad news last week from Minister of Finance Enoch Godongwana in his Medium-Term Budget Policy Statement (MTBPS), who indicated how longstanding structural constraints continue to limit economic performance in the country.

“Over the past few years, freight rail capacity and throughput have declined constraining growth and exports, while large-scale and prolonged power cuts have plagued mines, factories, farms, and households,” Mofokeng said.

“Despite a recent improvement, private sector investment growth has declined over the past decade.”

According to the analyst, this suggests a weaker outlook for domestic economic growth, lower than projected tax revenue and the inability of the economy to generate sufficient revenue to service government debt over the long term.

“Simply put, a few State-Owned Enterprises (SOEs) like Eskom and Transnet have negatively affected the growth of some of the main sectors of our economy such as mining, agriculture, and manufacturing.”

Mofokeng said that, unlike the last few years, where higher commodity prices have assisted in increasing tax revenues from mining companies, this year, commodity prices have fallen faster than expected, resulting in lower-than-expected tax revenues with value-added tax (VAT) refund claims having increased in the same period.

As expected, the lower tax revenue extends to manufacturing and agricultural sectors.

“Predictably, the ever-increasing petrol and diesel prices, and depreciating Rand worsened the situation,” he noted.

The Budget Review showed that this year, tax revenue collection is projected to be R56.8 billion below 2023 Budget estimates and have been adjusted lower for the medium term.

“All of this means that government must borrow more to balance its budget, and this debt accumulation has led to a rapid increase in debt-servicing costs, which now consume about 20% of the main budget revenue. For every R5 collected from taxpayers, R1 goes towards paying South Africa’s increasing debt of about R5.2 trillion.”

Hitting South Africa’s pockets

After listening to the bad news from the MTBPS, Mofokeng said South Africans are justified in worrying how this will affect their pockets.

While the government made some proposals on how to remedy the revenue crunch – including stabilising the public finances, reforming the economy to generate higher growth, further improvements in tax administration and broadening the tax base by SARS – it will still fall on the revenue service to up the ante in collecting tax.

According to the Finance Minister, SARS will continue to focus on enforcing compliance in areas such as debt collection, fraud prevention, curbing illicit trade, voluntary disclosure and encouraging honest taxpayers to comply voluntarily.

“Based on these proposals, it seems taxpayers are going to be squeezed even more by SARS,” Mofokeng said.

“SARS will be required to collect outstanding tax debts faster, more efficiently and increase audits on taxpayers which should hopefully result in more and larger assessments.”

Treasury has already committed to rasing R15 billion in additional taxes in 2024, with parliamentary groups and commissions proposing a host of tax measures – most prominent of which is a wealth tax.

For taxpayers, this may require more investment in resources including time to comply with their increased tax obligations, audit requests and in disputing assessments raised by SARS.

“For some taxpayers, the extra compliance may not be affordable as those resources may be better utilised for sustaining and growing their businesses,” the analyst said.

Despite the increased demands on SARS to collect more revenue, cost containment measures, such as the control measures implemented by the government for creating and filing of vacant posts are also applicable to SARS.

“Hopefully, these measures will not negatively impact SARS’ continued efforts to train, recruit, retain critical staff and modernise its tax systems that will enable it to improve on its assessments, and increase its revenue collection as expected by the government,” Mofokeng said.

The analyst said that South African taxpayers should continue honest engagement with SARS – but also stressed that there is an expectation for the government to urgently implement its promised reforms.

Read: 30% more taxes for 70% less healthcare – the NHI’s big problem