JSE-listed fintech reports earnings surge

Fintech group Capital Appreciation highlighted a strong acceleration in business activity in reporting financial results for the year ended March 2022., adding that it has a strong pipeline going into fiscal year 2023.

Capital Appreciation is a FinTech enterprise with three business segments – payments, software and a newly formed international division in the Netherlands. The group said it attracted a considerable number of new local and international clients, adding to its client base in the banking, financial, retail, healthcare, telecommunications, and more recently, logistics sectors.

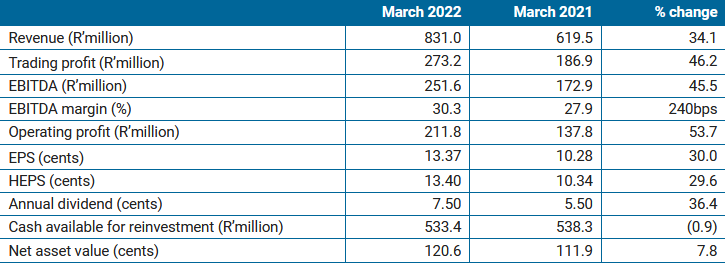

Revenue increased by 34% to R831 million, benefiting from large terminal orders and terminal transaction income growth, as well as significant increases in cloud-based and digital consulting revenue and third-party software and hardware sales, it said.

Headline earnings per share increased by 30% to 13.40 cents and dividends by 36% to 7.50 cents per ordinary share. The group also invested a sizeable amount on R&D and to set up its new operations in the Netherlands.

Capital Appreciation said its divisions remain highly cash generative, resulting in cash resources of R533.4 million at year-end.

The payments division grew revenue by 34% to R533.8 million, and EBITDA by 55% to R218.4 million. Terminal sales increased by 51% due to strong demand for Android terminals, which the group said was able to satisfy despite global semiconductor and supply chain challenges.

The terminal estate has grown at a compounded annual growth rate of 41% since 2017 and now comprises 277,000 units.

Dashpay’s specialised solutions increased transaction-related income by 69%, boosted by the launch of “Shôping”, a gift card solution developed for Attacq’s shopping malls.

Dashpay will also release its new tap-on phone SoftPOS app for Android devices, Dashpay Glass, in H1 2023. The group said its recurring payments associate, LayUp, continued to sign up new merchants and has seen a material increase in the number of payment plans initiated by customers on the platform.

“A range of new clients as well as recent inroads into Africa bodes well for further growth in the payments division,” it said.

Capital Appreciation said that the Halo Dot tap-on-phone technology has generated strong interest from local and international markets, attracting multiple new customers. The group recently acquired the Responsive Group, which designs and develops digital applications for clients in South Africa, the USA, Europe, and the United Kingdom.

Capital Appreciation joint CEO, Bradley Sacks, said: “In the five years since Capital Appreciation acquired its first operational companies to become a fully-fledged fintech enterprise, the group has maintained an unbroken dividend record, returning R370 million, or 26.25 cents per share to shareholders in the form of dividends.”

“The large pipelines in all our businesses are indicative of the strength of a longer-term global digitalisation trend. Capital Appreciation has the skills, experience, and track record to capitalise on the demand for these technological advancements and this will continue to support the positive growth prospects for the group.

“With a well-capitalised balance sheet, robust operating cash flow, and significant cash resources, the Group has the ability and appetite to take advantage of substantial organic growth opportunities as well as to consider complementary acquisition opportunities,” said Sacks.

Read: South African FinTech reports strong growth in payment space