This South African company is expected to be the next ‘unicorn’

The Hurun Research Institute has published its Hurun Global Gazelle Index 2021 – a list of the world’s start-ups founded in the 2000s worth over $500 million today.

The list of ‘Gazelles’ also includes startups not yet listed on a public exchange, that are most likely to ‘go unicorn’ – hitting a valuation of $1 billion – within three years.

Many of the world’s top investment houses provided details of their portfolio, which the Hurun research team cross-checked against specialized investment databases, industry experts, media sources, as well as Gazelle co-founders.

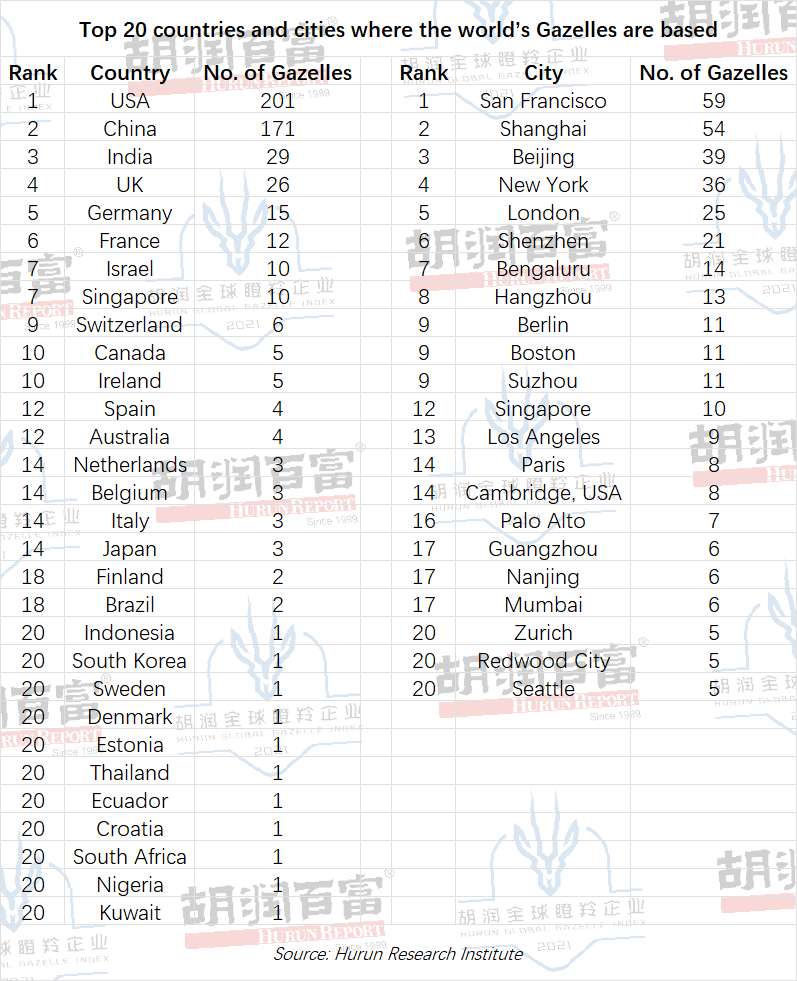

Based on this data, Hurun Research found 525 Gazelles located across 30 different countries and 134 cities. On average these startups were set up in 2014, with the vast majority selling software and services. Only 26% sell physical products.

55% are selling to businesses (B2B), whilst 45% of the companies are consumer-facing.

“2021 is officially the most successful year for start-ups ever. There are today more than 500 known Gazelles, leading a new generation of disruptive technology,” said Hurun Report chairman and chief researcher Rupert Hoogewerf.

“The speed of value creation is phenomenal. It took the Hurun Gazelles only seven years from founding to make it to Gazelle, meaning these start-ups started out in 2014 on average, when their founders were 34 years old.”

The USA and China led the list with 201 and 171 startups respectively, together accounting for 71% of the world’s known Gazelles. By city, San Francisco is the world’s Gazelle capital with 59. Shanghai is a strong second ahead of Beijing and New York. At the unicorn level, Beijing is still far ahead of Shanghai.

While South Africa’s fintech sector has seen a boom in recent years, only one company featured on the 2021 ranking – fintech startup Jumo.

The group, which describes itself as a banking-as-a-service platform, enable real-time access to funds at the lowest possible operating cost using artificial intelligence.

Headquartered in Cape Town, Jumo has offices in Kenya, Uganda, Tanzania, Rwanda, Ghana, Zambia, Singapore and the United Kingdom.

Jumo’s technology is a highly agile and scalable Platform as a Service (PaaS) for operating inclusive and profitable financial marketplaces, adapting quickly to customer needs with solutions that improve their lives.

The company partners with many of the largest, most forward-thinking banks and mobile money operators to offer individuals and small businesses savings and credit products via mobile devices.

Read: Norway and the UK are investing R600 million to help take South Africa off the grid