Storm clouds gather for South Africa

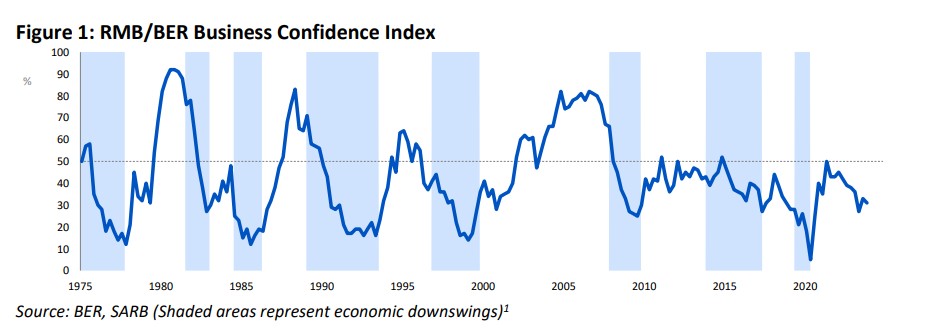

Confidence amongst South African business leaders remains incredibly low amid the challenging economic environment, which is likely to translate to slow economic growth and further strain on the economy for the remainder of the year.

The RMB/BER Business Confidence Index (BCI) dropped by two points to 31 in Q4 2023, meaning less than a third of respondents were happy with the overall business conditions.

Although there was a 15-point rise in retail confidence, it was outweighed by a major 24-point drop in the confidence of new vehicle dealers, pushing the overall index down.

“The business environment remained difficult in the fourth quarter, as business conditions deteriorated against expectations. In addition, activity ticked down somewhat despite an ease in load shedding relative to the third quarter,” the RMB said.

“Sluggish demand means that there is likely increased pressure on turnover and profitability, with purchasing prices reaccelerating but selling prices slowing for a fourth consecutive quarter.”

“While this is good news for the consumer as it may translate into lower consumer price inflation, this would have weighed on the confidence of businesspeople as they struggle to pass on higher input costs.”

Following the 24-point drop amongst new vehicle dealers, confidence declined to just 6 index points – the lowest level since Q2 2020 when the Covid-19 lockdown kickstarted.

The sector is struggling due to the weak local demand caused by high borrowing costs, with traders reporting high inventory levels.

Wholesale was the only other sector to report a decline in confidence – falling from 38 to 36 index points – as sales volumes continued to drop.

Confidence among building contractors was unchanged at 41 in Q4, following a two-point drop in Q3.

“The activity indicator suggests that the growth momentum is still going, albeit somewhat slower compared to the last few quarters. There is a risk that confidence in the residential sector could fade in coming quarters as high borrowing costs hurt demand in the residential property sector,” RMB said.

More positively, manufacturing business confidence increased to 26 index points. Nevertheless, this was subdued compared to other sectors, even if it was the highest level this year, following 19 points in the first three quarters.

“The increase was supported by an improvement in domestic and particularly export demand, as well as higher production volumes amid less frequent and less intense load-shedding,” RMB said.

“Manufacturers remain pessimistic about business conditions going forward and scaled back investment outlays further.”

Following declines in Q1 and Q32, the retail sector’s 15-point surge in Q4 has made it end the year at 47 index points – the average reading in 2022.

“However, the underlying survey results warrant some caution as overall sales volumes slowed, with the non-durable retailers reporting the steepest decline. Some non-durable goods have seen steep price increases of late, which tends to depress volume growth,” RMB said.

| Financials | Q3 2023 | Q4 2023 | Change |

| New Vehicle Dealers | 30 | 6 | -24 |

| Wholesale | 38 | 26 | -2 |

| Manufacturing | 19 | 26 | 7 |

| Building | 41 | 41 | – |

| Retail | 32 | 47 | 15 |

What this means

South Africa’s Real GDP is expected to slow in Q3, and the low confidence amongst businesses in Q4 does not indicate a significant reacceleration in momentum.

Besides poor activity growth, the business environment remained challenging, and trading conditions did not improve as respondents had initially hoped for.

Respondents noted the nation’s logistical challenges – port delays to potholes – with crime and corruption remaining key issues. Others said that they struggled to receive payment for goods delivered, which has knock-on effects on the whole production process.

“Structural supply constraints around infrastructure and electricity remain a key challenge to operating in

the South African business environment,” said Isaah Mhlanga, Chief Economist and Head of Research at RMB.

“However, the decline in the RMB/BER Business Confidence Index also reflects underlying demand weakness. The best example being the depressing outcomes for the interest-rate-sensitive new vehicle dealers this quarter, but local sales volumes remained sluggish across the board”.

If there is no pickup in demand, production growth is unlikely to accelerate, which is required to stimulate (non-energy) investment and employment growth.

Read: SARS changes the rules for certain businesses in South Africa