Interest rate pain on South African consumers is making its mark

Despite recording strong financial results first half of the year, Standard Bank says consumers are still struggling to pay back their loans.

For the first six months of the year, the group said that inflation remained elevated, interest rates continued to climb, and global growth slowed.

Looking exclusively at South Africa, these issues were exacerbated by continued slow reforms, poor service delivery, heightened load shedding and major logistics disruptions.

The South African Reserve Bank raised the repo rate by 125 basis points to 8.25% over the period, with inflation only returning to its target range of 3% to 6% in June.

“Interest rates have increased by 450 basis points since the start of 2022, placing considerable pressure on consumers and businesses. Consumer and business confidence remained low, and demand declined,” the group said.

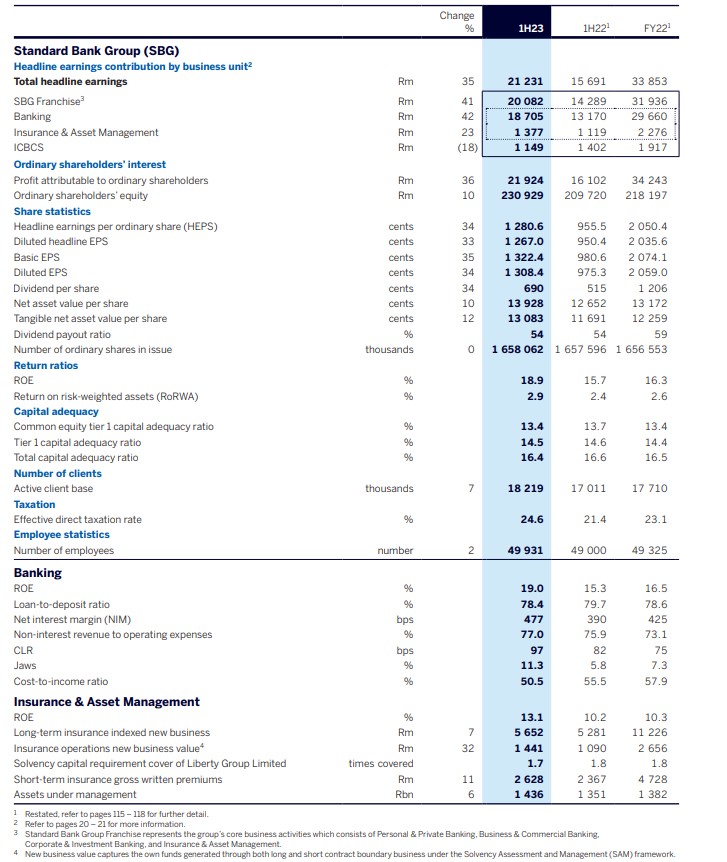

Despite this, the group still recorded headline earnings of R21.2 billion, up 35% compared to H1 2022.

“Our banking businesses benefitted from continued client franchise growth, larger balance sheets, increased transaction volumes, and certain market and interest rate tailwinds. Revenue growth was well ahead of cost growth which supported strong positive operating leverage and a decline in the cost-to-income ratio to 50.5%,” the group said.

In South Africa, headline earnings grew by 7% to R8.4 billion, whilst the Return on Equity (ROE) improved to 15.2% (1H22: 13.7%).

Amidst its strong performance, the group increased its dividend from 515 cents per share in H1 2022 to 690 cents per share in H1 2023.

Consumers struggling

Although the group posted a strong performance against the backdrop, its customers have been struggling, which can be seen in the rise in credit impairment charges.

The group said credit impairment charges increased across all its portfolios, indicative of the challenging economic environment, higher interest, the weak outlook, and sovereign credit risk migration in specific African markets.

The group’s credit loss ratio increased to 97 basis points, which is at the upper end of the group’s through-the-cycle range of 70 to 100 basis points.

The group’s credit impairment charges grew by 42% to R8.4 billion. Absa noted a similar trend: an impairment increase of 60%.

In South Africa, credit impairment charges grew across all portfolios, while the non-recurrence of credit recoveries on the payment holiday portfolio in 1H22 (R470 million).

South African outlook

Looking ahead, the group said that inflation will likely start to move within the SARB’s target range of 4.5% in the medium term.

The group also believes that the SARB will keep interest rates on hold at 8.25%, with the interest rate hiking cycle likely over.

It also expects real GDP growth to total 0.8% in 2023 – a relatively upbeat outlook considering the difficult start to the year.

“Moderating inflation, interest rate cuts (expect cumulative cuts of 125 basis points in 2024) and increased electricity supply should drive an improvement in confidence, demand, and investment in 2024. Real GDP growth is expected to be 1.4% in 2024 and closer to 2.0% in the medium term,” it said.

In addition, the group expects credit impairment charges to remain elevated, with its Business & Commercial Banking division’s credit impairment charges to remain high.

That said, it does expect some relief for households in the second half of the year.

Credit impairments for Personal and Private Banking clients are expected to decline in the second half of the year as the book growth slows and de-risking initiatives start to get results.

Corporate and Investment Banking impairment should match the charges in H1 2023, given persistent sovereign and corporate stress.

Read: Big changes coming for banks and insurers in South Africa