Massive R24 billion loss for Eskom

Eskom has reported a massive loss of R23.9 billion for the 2022/23 financial year, exacerbated by a huge escalation in load shedding, mounting municipal debt and skyrocketing losses due to criminal activity.

The group presented its full-year financials for the 12 months ending 31 March 2023 on Tuesday (31 October).

It said that the year was characterised by a significant deterioration in performance, including a steep decline in its energy availability factor of 56.03%, down from 62.02% in 2022.

Unplanned losses rose to 31.92% (2022: 25.35%), while planned maintenance remained the same.

Load shedding escalated severedly to 280 days, from 65 days in FY 2022, which impacted revenues. Load had to be curtailed by an estimated 13,476GWh, the group said, up from 1,605GWh in 2022.

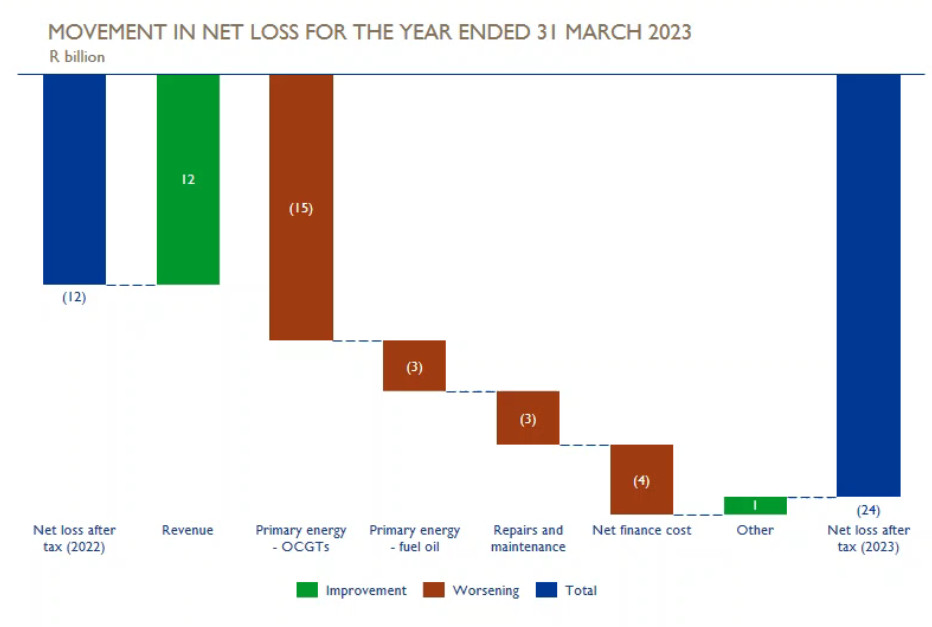

This resulted in a staggering jump in spending on the group’s gas turbines, with spending more than doubling from R14.7 billion in 2022 to R29.7 billion in 2023.

Eskom is spent over R7,000 per MWh to run the generators, making it by far the most expensive form of generation. Given the constraints in the market, the price of generating power increased for all forms of energy, except for renewables, which saw a 2% drop in price.

The group reported a total net loss after tax of R23.9 billion (from R11.9 billion in 2022). This was despite a 9.61% hike in tariffs.

Looking at the group’s overall results summary, it is a sea of red, with revenue being the only increase.

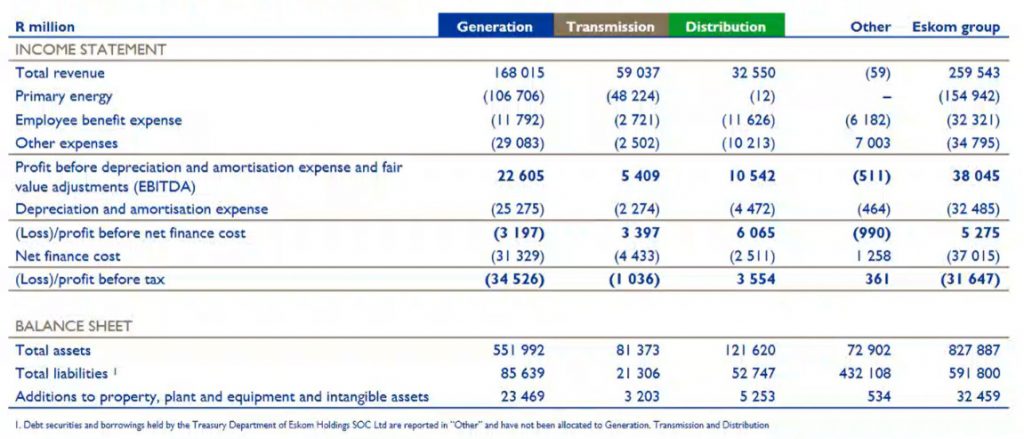

Revenue climbed to R259.5 billion for the year, but earnings before tax, depreciation and amortisation dropped to R38 billion.

A glaring hole for the group is municipal debt, which has hit R58.5 billion at FY23, it said. This is up from R44.8 billion the year prior.

However, the group also noted mounting losses related to irregular and wasteful expenditure as well as losses attributed to criminal activity.

With irregular expenditure, the group’s closing balance was R91.15 billion for the year, having incurred further irregular spending of R5 billion during the year. This comprised R2.6 billion of new incidents and R2.4 billion of historic incidents.

R252 million was recovered or condoned.

In terms of wasteful expenditure, Eskom said it only incurred R105 million of new expenditure categorised as fruitless or wasteful, R2 million of which was recovered.

However, the group ended the year with a massive R6 billion of “material losses” attributed to criminal activity.

This includes R344 million related to theft and damage to equipment, R81 million attributed to fraud and corruption and a whopping R5.6 billion linked to “non-technical losses”.

Eskom said that this R5.6 billion is its estimate of its losses due to electricity theft by communities and other similar incidents.

According to the group’s income statement, the Generation unit remains the biggest drag on finances.

2024 Outlook

Looking ahead to the 2024 full year, Eskom expects its losses to continue, currently projecting another R23.2 billion loss for FY24.

While the 18.65% increase to tariffs for 2024 will boost revenues, this will be tempered by an estimated 2% decline in sales volumes.

The financial performance is also expected to be contained by the poor performance in EAF (below 60%) as well as delays in IPP programmes.

Spend on gas turbines is expected to be within budgeted levels of R28.5 billion – however, this continues the escalation and dependence on this costly form of generation.

According to Eskom acting CEO Calib Cassim, the 2024 full year should be the last year of such harrowing results, with the group’s turnaround strategy and improvements likely to feed through in 2025 and beyond.

Read: The good times are over – how Eskom managed to suspend load shedding for so long