Construction stumbles in South Africa as developers sweat

The number of overall building completions and plans passed declined in Q3 despite some areas of positivity amongst builders.

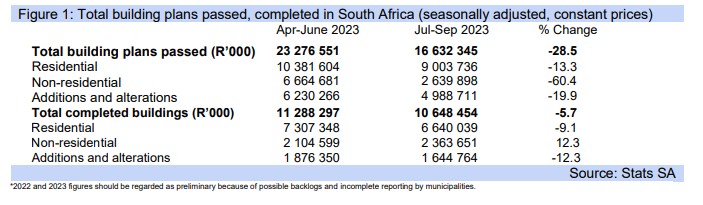

According to Stats SA, the value of buildings reported as completed by larger municipalities declined by -5.7% in real terms in Q3 2023 when measured on a quarter-on-quarter seasonally adjusted (qqsa) basis.

Drops were logged in the Residential (-9.1% qqsa) and additions and alterations (-12.3% qqsa) categories, with the latter supported by the poor performance of the hardware, paint and glass segment of the retail sector (-2.4% qqsa).

“Residential property demand continues to be impacted by the fragile economic environment, with consumers still grappling with high-interest rates, which are expected to remain at elevated levels for longer,” Investec’s Lara Hodes said.

In addition, confidence amongst builders in the residential segment has declined, according to the FNB/BER Building Confidence Index.

The outlook for work deteriorated according to respondents’ expectations, which aligns with the drop building plans passed reading for Q3, which showed that plans passed dropped by -13.3% qqsa.

However, looking more positively, activity in the non-residential market segment grew over the period, climbing by 12.3% qqsa.

This aligns with the sentiment amongst non-residential builders in the FNB/BER survey, which jumped from 42 in Q2 to 52 in Q3 – a multi-year high.

“Indeed, a review of the office segment, which was heavily affected by the lockdown restrictions imposed

during the pandemic, confirms that office vacancy rates improved further in the third quarter,” Hodes said.

The latest SAPOA Office Vacancy Survey revealed that the overall office vacancy rate was at 15.5% (down 10 basis points) at the end of Q3.

“Pipeline activity, however, does not look as favourable. It dipped notably when measured on a quarter-on-quarter seasonally adjusted basis and by -3.2% year-to-date compared to last year,” Hodes added.

“Indeed, a notable lift in business confidence is still needed to drive sustainable levels of investment.”

Read: Consumers in South Africa are under pressure – but still making their way to Woolies