Economists reverse interest rate expectations for South Africa

Economists at the Bank of America have shifted their expectations for the South African Reserve Bank’s next policy move, now falling in line with the wider expectations that the Monetary Policy Committee (MPC) will hold and rate hikes have ended.

BofA has historically been one of the more hawkish institutes when it comes to South Africa’s policy rates, being an outlier warning that the Reserve Bank could push interest rates higher by another 25 basis points in its final meeting for the year.

This has been premised on the fact that inflation is still a risk in the country, given the near-term pressures of higher fuel prices (in September and October), higher global interest rates and other challenges like the avian flu outbreak and inclement weather.

More recently, a spike in global oil prices in October also added weight to the view that inflation pressure is going to be sticking around.

However, the finance group has now changed its tune, saying these risks will likely not follow through to the extent previously forecast.

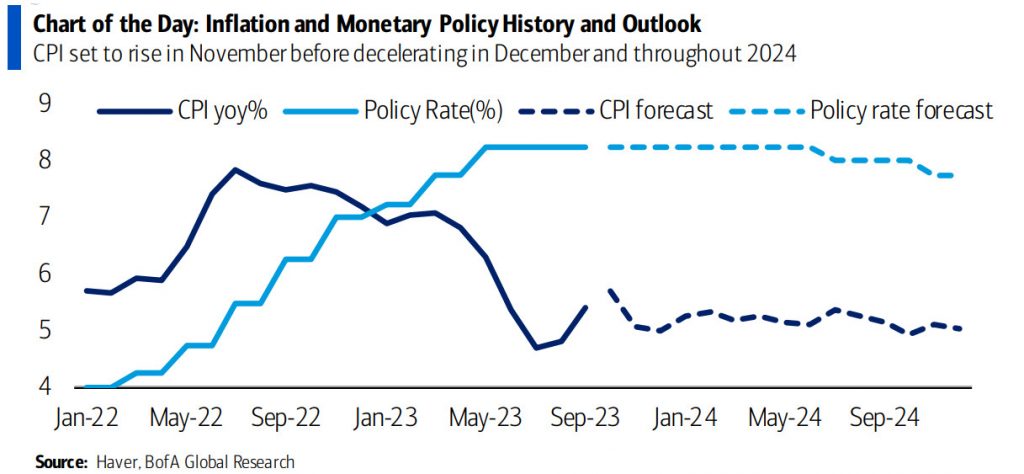

“We are reversing our call for a SARB hike at the November 23 meeting. New risks – particularly oil prices – have pulled back the 20% spike from late August into early October. Year-end inflation of 5% and a policy rate of 8.25% is more than a 3% positive real rate – enough for SARB to remain on hold, in our view,” it said.

“We now expect the SARB to stay on hold at the November meeting and in 1H24. We think it’s likely to keep rates higher for longer. We see the next move as a cut to the policy rate. We forecast cuts of a cumulative 50bp in 2024 starting in July and 75bp in 2025,” the bank said.

BofA noted that the previous two holds on the interest rate were accompanied by hawkish tones from the central bank.

Easing inflation towards 5% will help the SARB to leave rates unchanged for the next few meetings in 2024.

Inflation spiked up in September to 5.4% due to rising fuel and food prices, and is expected to rise again for October (BofA has pencilled in 5.7%) for the same reasons. However, this is expected to drop to 5.1% by the end of the year.

With inflation looking to ease, a hold on rates is also supported by the US Fed’s latest decision to hold, which Bank of America said is indicative of the US hike cycle also ending and cutting expected from mid-2024.

One unknown remains, however, and that’s the number of voters behind the SARB’s next move.

“Deputy Governor Kuben Naidoo resigned in October, while his departure date is still to be confirmed, possibly leaving the MPC with just four members. They are likely to be cautious on hikes, especially if data is supportive of keeping rates unchanged.

“The cutting cycle will depend on global interest rates and domestic inflation dynamics,” the bank said.

The SARB’s MPC will meet next week and deliver its final interest rate decision for 2023 on 23 November.

Read: Good news for interest rates in South Africa expected next week