Relief for retail in South Africa

Retail sales in South Africa have registered the first expansion of 2023, but consumers will likely remain under pressure for the rest of the year.

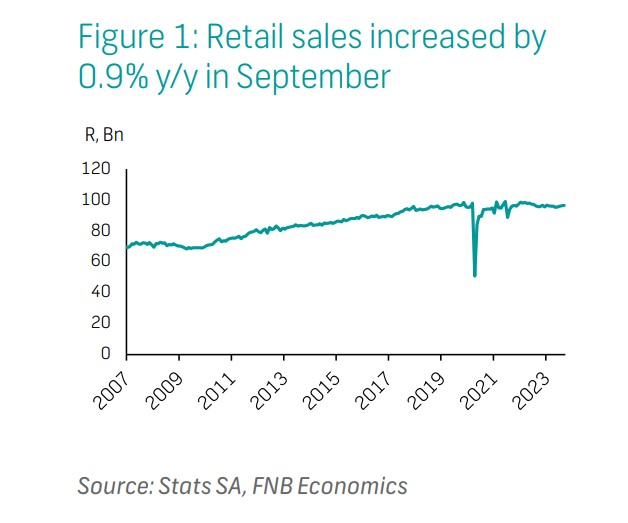

According to Stats SA, retail sales increased by 0.9% y/y in September – better than the Reuters consensus expectation of a 0.1% y/y increase.

Looking monthly, seasonally adjusted volumes grew by 0.1% m/m, down from an upwardly revised 0.3% in August.

“This outcome implies that the sales volumes rebounded by 0.8% q/q from a decline of 0.8% in 2Q23, suggesting that the retail industry added to 3Q23 GDP growth,” Siphamandla Mkhwanazi, FNB Senior Economist, said.

“This contrasts with the productive sectors of the economy (mining and manufacturing) that dragged growth in 3Q23.”

“Still, the year-to-date volumes are 1.5% lower than the same period last year, underscoring the challenging consumer backdrop.”

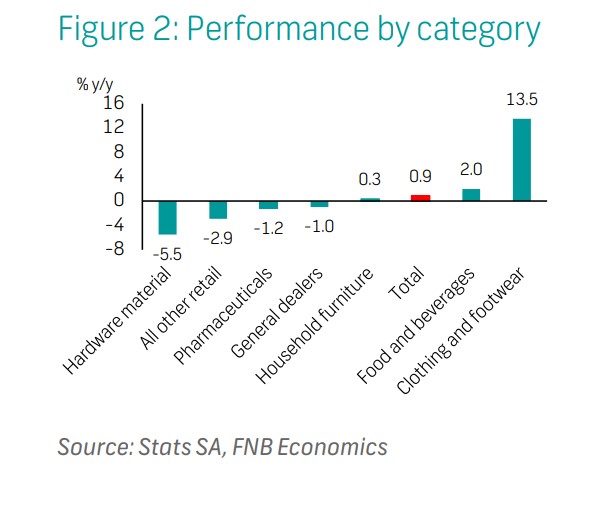

Despite the positive overall sales, only three of the seven categories saw an expansion in annual volumes.

Clothing and footwear retailers continued their strong performance, with 13.5% y/y volume growth – adding 2.0 ppts.

Food and beverages retailers also saw growth of 2.0% y/y – a 0.2 ppts contribution, while Household furniture sales increased marginally by 0.3%, with a minor contribution to headline growth.

On the other hand, General dealers (-1.0% y/y, detracting 0.5 ppts), Hardware retailers (-5.5% y/y and -0.5 ppts), Other retailers (-2.9% and -0.3 ppts), and Pharmaceutical retailers (-1.2% y/y, and -0.1 ppts) dragged on sales.

Outlook

“Credit data suggests that demand and supply for consumption credit, especially credit cards, remains strong, both in the bank and non-bank sectors,” Mkhwanazi said.

“In addition, anecdotal evidence suggests that real wage growth might be turning marginally positive for the first time since 2H21, largely due to slower inflation. If sustained, this could provide modest support to shopping activity in the near term, heading into Black Friday and the Festive Season.”

That said, FNB predicts further tightening in lending standards as the impact of past interest rate hikes filters through the economy, whilst depressed consumer sentiment limits the upside.

FNB thus predicts subdued growth in household consumption expenditure for the rest of 2023.

This also spells bad news for South Africa’s GDP figures for 2023.

“Household consumption expenditure, which makes up around two-thirds of GDP, is likely to remain lacklustre in the short term with a forecast of 0.8% for the year,” Investec’s Lara Hodes said.

Read: Good news for interest rates in South Africa expected next week