Eskom is in trouble

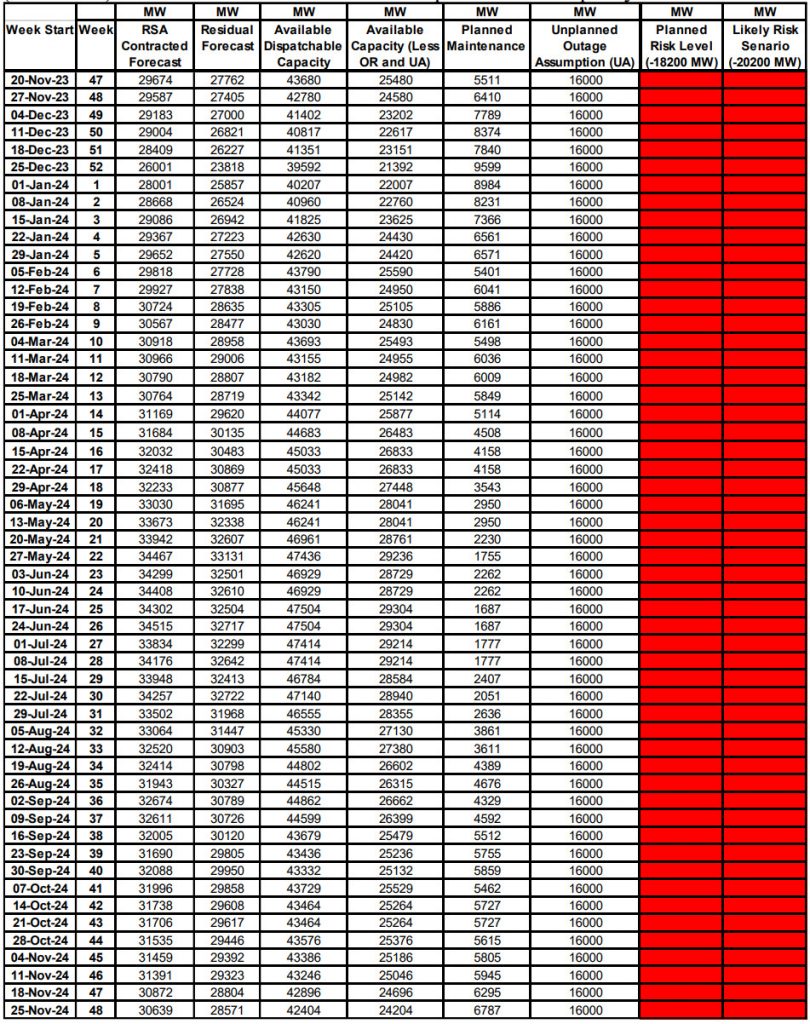

Power utility Eskom’s latest system status report is once again a sea of “code red” as even slight gains made in recent weeks have reversed the group’s short-term outlook.

Although the previous report (for week 45) was still largely dominated by “code red”, the group saw slight relief on the cards at least in some weeks ahead.

However, the latest report has returned to a full-scale code red for the next 52 weeks.

The system report features a 52-week projection for energy, which is coded based on the expected supply and demand.

Code Green indicates that the group expects adequate generation to meet demand and feed reserves.

Code Yellow projects a small shortfall to meet reserves (under 1,000MW) but adequate supply to meet demand.

Code Orange anticipates a 1,000MW to 2,000MW shortfall, “definitively” failing to feed reserves and possibly demand.

Code Red is when there is a 2,000+ MW shortfall where both reserves and demand won’t be met, the group said.

In its assessment of the year ahead, Eskom provides both a “planned” risk level – based on its baseline assumptions of megawatts that will be unavailable – and a “likely” risk scenario, based on the baseline assumption being exceeded by 1,500 MW.

The assumptions are all based on the last week of available operational data.

This particular assessment is based on an assumption that 16,000MW will be out due to unplanned outages. Including reserves of 2,200MW, Eskom “plans” around 18,200MW being offline due to outages.

In the “likely” scenario, this ramps up to approximately 20,200MW.

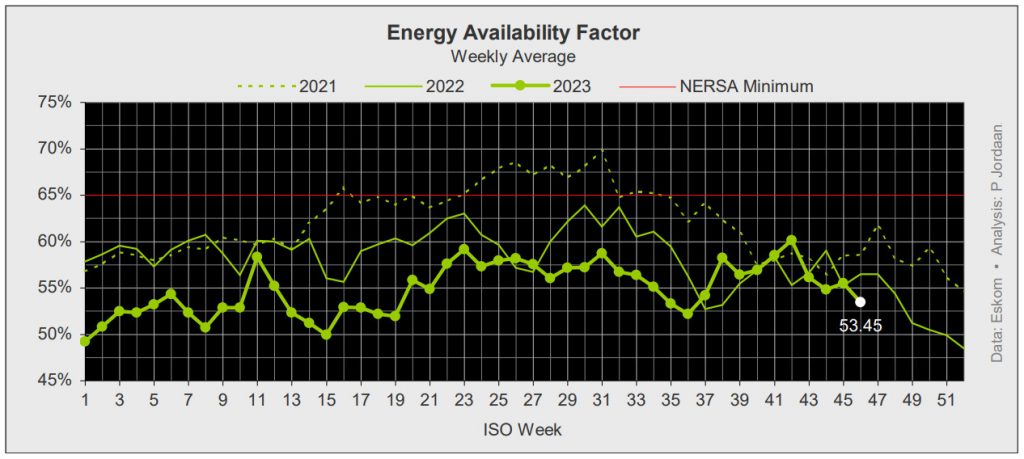

The system report aligns with the latest plant performance data compiled by independent energy analyst Pieter Jordaan, based on the statistics from Eskom for week 46.

According to Jordaan, the data releases from Eskom have been delayed, which is often an indication of trouble.

Indeed, contrary to the political statements indicating improvements in Eskom’s generation capacity, the latest data shows that the group’s Energy Availability Factor (EAF) has regressed from the much-celebrated 60% level reached a month ago.

“The 60% EAF that parliament was briefed on in week 43 relapsed past the May baseline of 53.7%, just four weeks later,” Jordaan said.

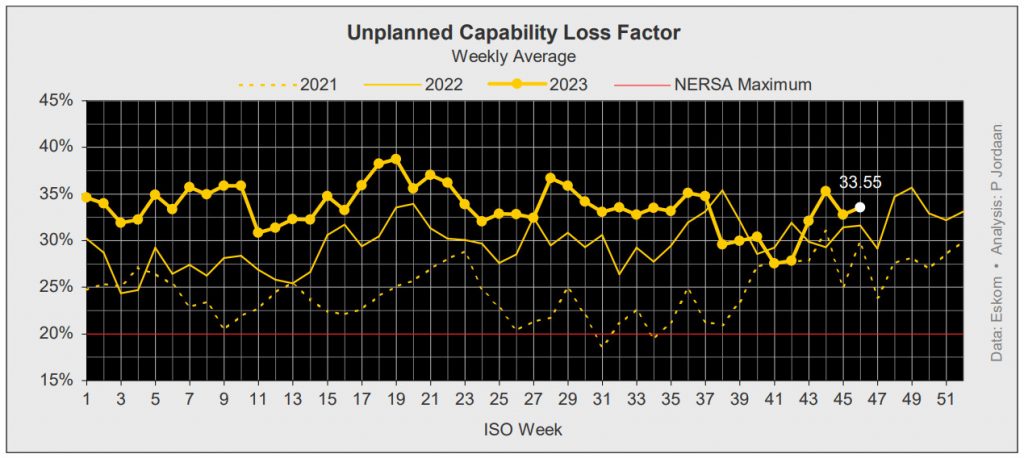

This has been accompanied by escalations in breakdowns, which the analyst noted have now entrenched above 30% (approximately 16,000MW) and are far above the 20% limit imposed by energy regulator Nersa.

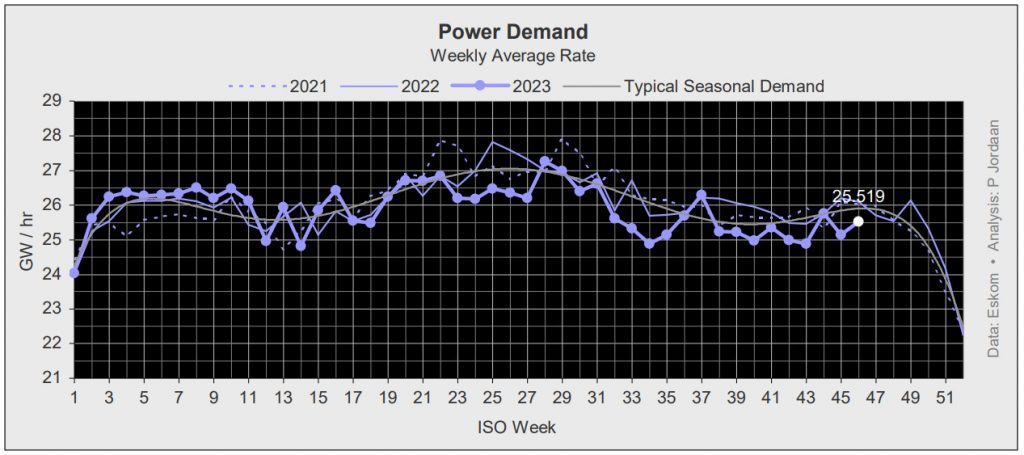

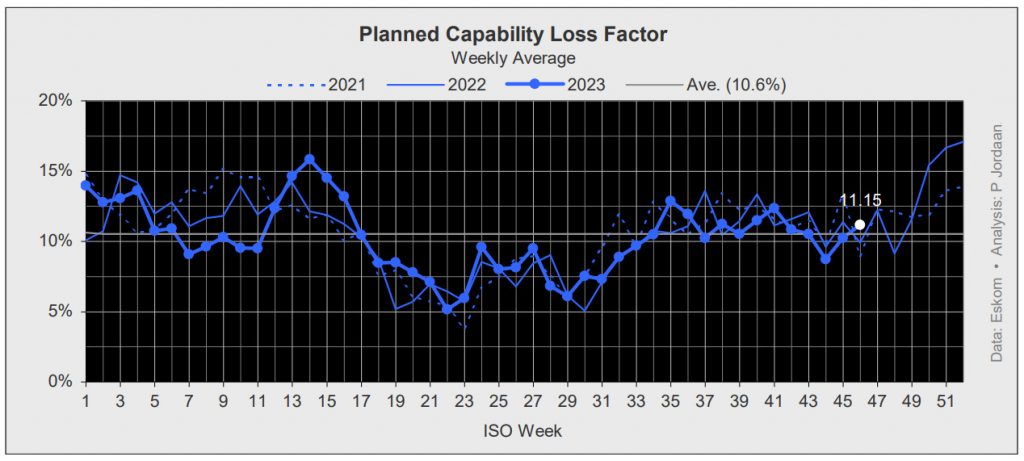

Eskom’s “better” performance in recent months can largely be attributed to two main factors: a drop in planned maintenance (Eskom taking fewer units offline) and lower demand (South Africans using less electricity or moving on to different energy sources).

In the last two weeks, both of these factors have reversed, contributing to the escalation of load shedding – demand and planned outages have both ticked up slightly, while Eskom has experienced more breakdowns.

Notably, demand is still far below “normal” patterns, which means that South African energy users or alternative energy users are still doing some heavy lifting in keeping load shedding at bay.

Because of these factors, stage 4 load shedding is back – with the risk that a nudge from any side (more breakdowns, higher demand, more maintenance) could push the stages higher.