Here is the expected petrol price for December

Mid-month data from the Central Energy Fund (CEF) points to another big month for petrol and diesel price relief in December 2023.

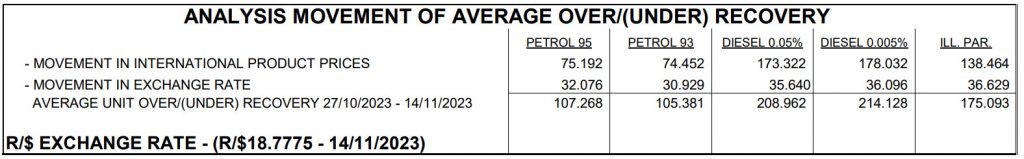

The CEF’s data points to a drop in petrol prices of around R1.05 per litre, while diesel is lining up for a cut of up to R2.14 cents per litre.

If these over-recoveries carry through to the end of the month, motorists and other fuel users will catch a much-needed break ahead of their travels for the festive season.

These are the expected changes:

- Petrol 93: decrease of 105 cents per litre

- Petrol 95: decrease of 107 cents per litre

- Diesel 0.05% (wholesale): decrease of 209 cents per litre

- Diesel 0.005% (wholesale): decrease of 214 cents per litre

- Illuminating paraffin: decrease of 175 cents per litre

Daily snapshot data for LP Gas is not presented by the CEF.

The Department of Mineral Resources and Energy (DMRE) has noted that its daily snapshots are not predictive and do not encompass other possible modifications, such as slate levy adjustments or retail margin changes. The department determines these adjustments, considering various factors, at the end of the month.

Domestic fuel costs are primarily governed by the rand/dollar exchange rate and international oil prices. In South Africa, the fuel price is adjusted on the first Wednesday of every month based on these two factors.

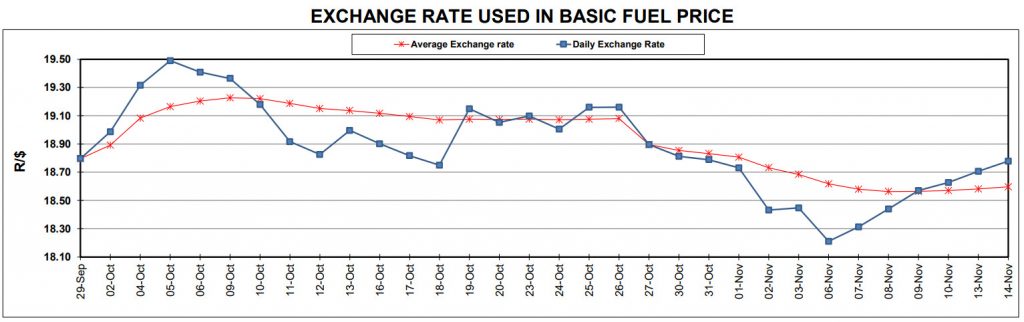

For December, lower oil prices have been working in the favour of lower prices, while a moderately stronger rand has also been adding to the over-recovery.

Rand

The rand has experienced some relatively wild swings in recent weeks, having been sustained below R19 to the dollar for much of the month.

The local unit got a strong boost from the wider risk-on environment in the markets following US economic data pointing to the prolonged hiking cycle of interest rates coming to an end.

However, this was later tempered by hawkish comments from US Federal Reserve Chair Jerome Powell, saying that inflation was still too high and that future hikes could not be discounted.

On Wednesday (15 November), the rand made another swing as markets awaited retail data from the States. The rand is currently trading at R18.20 to the dollar, down from the R18.80 levels hit earlier in the week.

Given the rand’s journey over the past week or so, it is apparent that local market movements are being driven by non-local data, and much of the rand’s fortunes are tied to the US and related events

South African problems – like load shedding, infrastructure woes and the fight to close the budget gap – are taking a back seat and are likely already priced into the rand and have been for some time.

According to Investec chief economist Annabel Bishop, the rand is likely to remain volatile as market risk-taking rises and weakens as sentiment wanes.

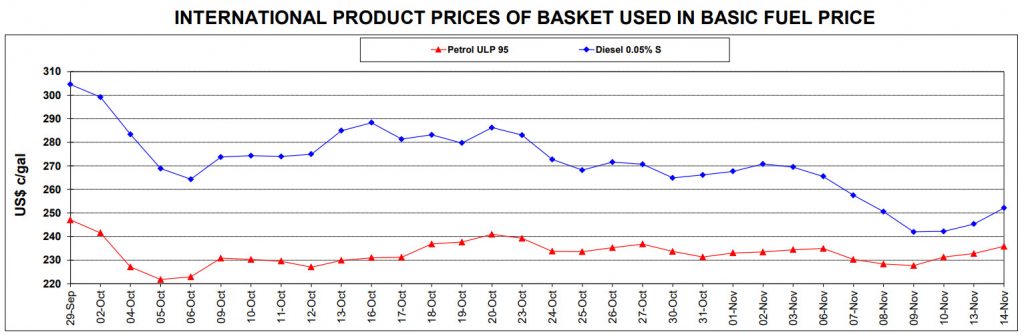

Oil

Oil prices have seen a sharp drop in November, following a rapid rise after war erupted between Hamas and Israel in October.

The war in the Middle East stirred fears that more countries would get pulled into the conflict, sending oil prices surging to over $95 a barrel, with markets eyeing a move above $100.

However, as the escalation did not happen, and the reality of China’s lower demand (and ample supplies in the US) fed through, the oil price fell back down and even dropped below the $80 a barrel mark last week.

Given the turn in pricing, this is reflected in the international cost of petroleum products, which is working in motorists’ favour in current forecasts.

However, economists have warned that this is not the end of the oil price stresses, with the risk of escalation in the Middle East ever-present, threatening to send prices surging once again.

While this may not feed through in the immediate term (ie, December 2023), it may be a reality motorists will have to face in 2024.

With global benchmark Brent trading near $83 a barrel, analysis from Bloomberg noted that oil markets will be kept on edge for some time.

“Oil has fallen sharply since mid-October as the Israel-Hamas war risk premium evaporated and doubts set in about the demand outlook before rising in the three days through Monday,” the group said.

“It’s lacked direction since then, with worries over the health of the global economy balanced by indicators that still show the market is in deficit.”

Here is how the expected prices could reflect at the pumps.

| Inland | November Official | December Expected |

| 93 Petrol | R23.44 | R22.39 |

| 95 Petrol | R23.90 | R22.83 |

| Diesel 0.05% (wholesale) | R24.17 | R22.08 |

| Diesel 0.005% (wholesale) | R24.40 | R22.26 |

| Illuminating Paraffin | R17.95 | R16.20 |

| Coastal | November Official | December Expected |

| 93 Petrol | R22.72 | R21.67 |

| 95 Petrol | R23.18 | R22.11 |

| Diesel 0.05% (wholesale) | R23.44 | R21.35 |

| Diesel 0.005% (wholesale) | R23.71 | R21.57 |

| Illuminating Paraffin | R17.02 | R15.27 |

Read: Big trouble ahead for petrol prices in South Africa, economist warns