Important questions for South Africa’s biggest banks

Nedbank is South Africa’s most environmentally-conscious bank – but the nation’s biggest banks still need to do more to address the climate crisis.

All of South Africa’s “big five” banks have claimed in major marketing pushes that they support climate science and are leaders in sustainability.

However, there have been questions over the commitment to addressing the climate crisis from institutions that manage the savings of ordinary South Africans.

Non-profit shareholder activism organisation Just Share has assessed how serious banks in South Africa are about ending their financing for fossil fuels and the transition to a low-carbon economy.

Just Share thus looked at the climate-related discloses, policies and practices of Absa, FirstRand, Investec, Nedbank, and Standard Bank over the last six years – Capitec was omitted as it does not provide investment financing or other corporate investment services.

The report looks at four broad categories – fossil fuel exposure (current status), emission reduction targets (future status), governance and strategy and sustainable finance – with 20 indicators. It gives a score out of 85 points.

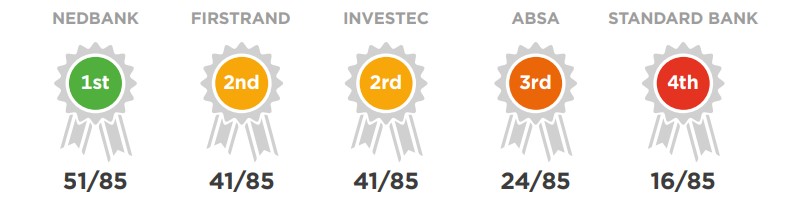

With a score of 51/85, Nedbank is the best bank for understanding and managing climate risk.

Investec and FirstRand are tied for second, with a score of 41/85.

Just Share noted that there is a huge gap between the frontrunners and Absa and Standard Bank, with Absa scoring 24/85 and Standard Bank 16/85.

“Despite all the banks expressing their commitment to climate action, four of the five increased their financing and exposure to fossil fuels over the reporting year. Only Investec’s fossil fuel financing and exposure decreased due to a large and unexplained reduction in the bank’s oil exposure,” Just Share said.

“The large gap between leaders and laggards shows that qualified and climate-competent leadership at the board level is key to banks’ progress on climate issues. Internal rather than external factors drive performance across the 20 indicators.”

All the banks have recognised climate risks and committed to global climate goals, with all of them publishing their climate or energy policies.

Despite most banks not being members of the Net-Zero Banking Alliance, they have committed to ending their financed emissions to net zero by 2050.

That said, banks have made the least progress in recognising and acting on the climate risks of fossil gas.

“Nedbank is the only bank that has committed to zero fossil fuel exposure by 2045 (except for backup supply for renewable energy projects), indicating that it will continue to finance gas production ‘where it will play an essential role in facilitating the transition to a zero-carbon energy system by 2050,'” Just Share said.

All the other banks have said that they intend to finance the exploration, extraction and production of gas in the medium to long term.

“The task that we’ve set for ourselves – to decarbonise the global banking sector – is both critical and ambitious. The impact of climate change on the planet following decades of unchecked emissions is manifesting itself in many ways, and the need for action is urgent,” NZBA Chair Tracey McDermot said.

“Decarbonisation requires a change in the real economy, but banks are crucial to enable that change by providing finance to support clients and countries to transition to a new low carbon economy.”

“South African banks are failing to act with sufficient urgency to meet this moment. Driving them to do so requires sustained pressure from all stakeholders, including the banks’ customers,” Just Share concluded.

Read: Money is flooding out of South Africa – and it won’t stop any time soon