South Africa’s new state bank is dropping the ball

South Africa is set to get a new state-owned bank, but recent failures have seen customers turning to private banks.

President Cyril Ramaphosa recently signed the Postbank Amendment Bill into law, which will transfer the Postbank shareholding from the South African Post Office to the government. This will permit for the creation of a Bank Controlling Company – the holding company of a bank.

Although Postbank already offers some financial services, such as savings accounts, the government wants to expand its products by offering affordable financial services to communities not catered for by traditional retail banking, SMEs and the public sector.

However, the current failures of the Postbank in paying grants is seeing more South Africans turn to the private sector.

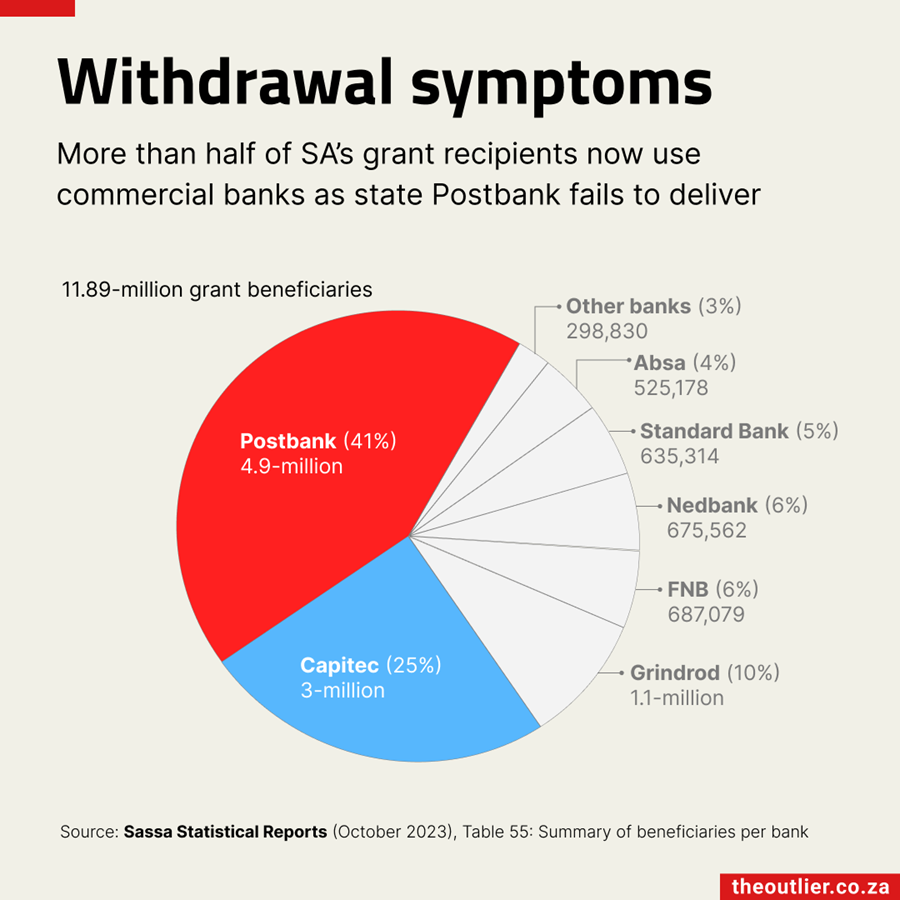

According to the Outlier, nearly 60% of the monthly payments to SA Social Security Agency (Sassa) grant recipients are made into private bank accounts.

Although the rest get their money through their Postbank or Post Office accounts, this is declining in number.

“State-run Postbank took over payments from the Post Office in October last year, the third time in five years that Sassa changed the agency responsible for administering grants. Between 2012 and 2018, Cash Paymaster Services, working with Grindrod Bank, was responsible for grant payments,” the Outlier said.

“The transition to Postbank has not been smooth and there are regular reports of grantees not receiving their funds on time.”

For instance, in September, Postbank said that it was experiencing intermittent technical issues at ATMs and retailers, which left over 500,000 beneficiaries without any income. Although the technical error was fixed, some were still unable to access their funds from September.

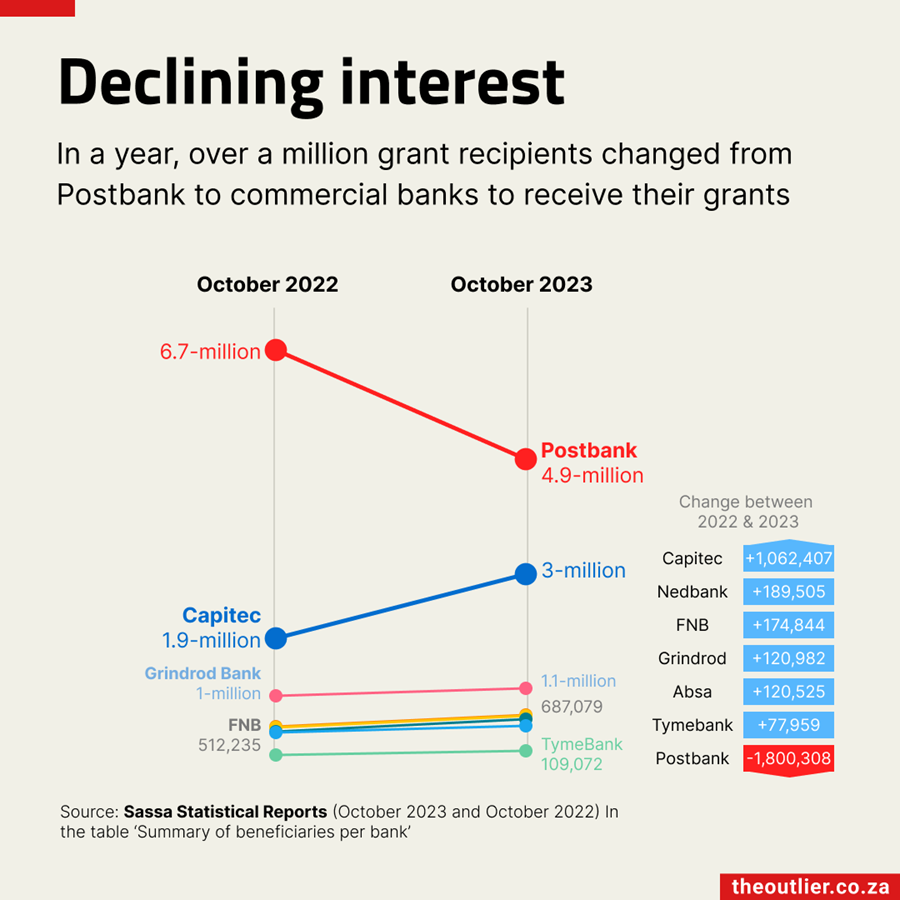

Due to these failures, Sassa beneficiaries have increasingly turned to commercial banks, wit the number of recipients with accounts at the Postbank dropping by 1.8 million from October 2022 to October 2023.

Capitec saw the number of grant account holders increase by 54% to 3 million during the same period.

Several other banks, including Nedbank (+190,000), FNB (175,000) and Grindrod (+120,982), also saw an increase in the number of grant payments received.