Calls for more taxes on the rich and businesses in South Africa

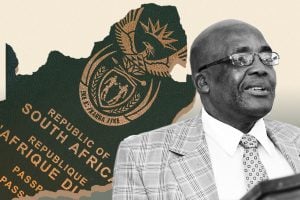

The Alternative Information and Development Centre (AIDC) – a non-government organisation and socioeconomic think tank – has lambasted finance minister Enoch Godongwana’s medium-term budget, saying that South Africa has plenty of revenue sources available, making budget cuts unnecessary.

In fact, the group said that the government should be spending even more money, especially on public services, wages, and filling vacant positions in government.

This can all be funded through higher taxes on the rich and by cutting the tax incentives for “the affluent minority and major corporations”, it said.

“A number of tax measures can be implemented immediately and over the medium term to raise more revenue.

“The medical aid tax deductions cost the fiscus R35 billion per year. The 1%-point cut in the corporate income tax rate from 2022 can be reversed. The ‘inflationary relief’ provided every year even to high-income earners should be scrapped,” the group said.

Together, these measures could raise in excess of R50 billion in forgone revenue for this financial year, it said.

The group also wants the government to introduce a wealth tax of between 3% and 7%, which it said could raise R140 billion annually.

While the revenue sources explored by the AIDC focus on wealthier individuals, it also takes aim at the government.

Notably, it said that stopping illicit flows and profit transfers by companies to tax havens could secure another R100 billion each year. In addition, the Government Employee Pension Fund surpluses could also be tapped into to the tune of R50 billion, without impacting pensions.

The AIDC argued that cutting budgets – which is now the case – threatens to exacerbate South Africa’s social crises, as money is taken away from vital services like healthcare and education at a time these departments are already under strain.

“When we consider this three-year budget framework, it is as if the Treasury and government more generally ignore that South Africa has a mass unemployment crisis – probably the worst in the world.

“On the other hand, austerity budgeting assures investors and the elites that they will not be taxed to relieve the suffering of the vast majority of the population. And it signals to creditors their money will be repaid, come what may.”

“The Treasury’s uncompromising position on this issue will only worsen the matter. Instead, resources ought to be dedicated to expanding both compensation and employment.”

South Africa’s reality

South African taxpayers are already incredibly overburdened, with a small percentage of the population paying the majority of the taxes.

Economists and the Treasury itself have long argued that any more tax hikes or additional pressure from the government on this tax base could lead to further erosion.

Despite this, a narrative has continued that the wealthy in South Africa are an untapped source of tax revenue.

The South African Revenue Service (SARS) has placed a particular focus on wealthy individuals and has managed to draw close to R3 billion in tax revenue from them. Meanwhile, auditing process have also sniffed out billions in “hidden” tax revenue from individuals and companies (and trusts) that try to circumvent their tax obligations.

According to consultancy PwC, South Africa has a tax gap of around R300 billion – representing the difference between what is owed to SARS versus what is collected. The group said that improving tax collections and getting what is owed would go a long way to meeting the country’s budgetary shortfalls.

The rub for the AICD (and for wealthier South Africans) is that the government is doing away with the tax relief anyway – even with the austere budget.

Investec chief economist Annabel Bishop said that the R15 billion that the National Treasury intends to raise in 2024 will likely come from keeping tax brackets the same – meaning they won’t be adjusted for inflation to keep in line with salary hikes.

Further to this, the National Department of Health has already confirmed that medical aid tax credits will also eventually be scrapped, and the resultant savings by the government will be fed into the National Health Insurance Fund.

This would leave the wealth tax and corporate tax.

South Africa has already seen an exodus of high-net-worth individuals over the last decade. Data from SARS and other anecdotal stats (from the property sector, for instance) shows that wealthy South Africans are unlikely to stick around for the government to tap them for more money.

As for corporate tax, even with the one percentage point cut to the tax rate, corporate tax disappointed in 2023 (exacerbating the shortfall), and many companies are struggling to keep operations going amid the country’s failing electricity and infrastructure landscape.