Lower load shedding boost for MTN

Decreasing levels of load shedding has benefited MTN’s network performance, with the group seeing a marginal increase in subscriber numbers.

“MTN maintained a resilient performance in the first nine months of 2023, as inflation remained elevated across our markets, with an average blended rate of 17.3% year-to-date (YTD) compared to 14.2% in 2022,” Group CEO Ralph Mupita said in the group’s Q3 FY23 update.

Inflation also started to slow in several regions, but forex markets remained volatile over the period, with the weakening of the Naira materially impacting the group’s results.

“Power outages in South Africa continued to be a challenge in the period, however, the significant progress made in our network resilience programme – which is tracking slightly ahead of plan – combined with lower load shedding in Q3 (compared to H1), has supported average network availability of above 95%,” Mupita added.

Amidst MTN SA’s better network performance, the group increased its subscribers to 36.8 million – with 59k new subscribers over the quarter.

Postpaid subscribers grew 8.3% to 4.1 million (excluding telemetry), but prepaid customers were flat from the prior year at 27.8 million.

Outgoing voice revenue dropped 12.8% YoY, but this slowed down from the 16.0% in Q1.

“In addition to enhanced network availability, the better performance in voice revenue was also supported by increased Xtratime penetration. Xtratime penetration rose to 26.2% in Q3 (2022: 25.3%). Overall voice revenue (including incoming voice) declined by 12.4% YoY,” the group said.

Data was again the central area of growth for the business as mobile data revenue jumped 8.3% YoY, making up 47.9% of MTN SA’s service revenue YTD. This comes after a 3.4% increase in active data subscribers to 19.5 million.

Usage trends skyrocketed as prepaid data subscribers used an average of 3.0GB of data a month (up 20.3% YoY), and active postpaid subscribers used 15.2GB per month (up 24.3% YoY).

During the quarter, several online initiatives were created to create growth in voice traffic and users, with the group also seeing growth in its residential business following the introduction of new services, such as MTN Fibre.

Outlook

“The operating environment in the period ahead is expected to remain challenging, with inflation

remaining elevated and currencies under pressure,” the group said.

“While these effects are anticipated to continue in Q4, we are positioned well to weather the uncertainty through strong operational execution in line with our Ambition 2025 strategy.”

The group said that it will curb inflation and shocks to its businesses through its reliance initiatives in its commercial, supply chain, network and financial services operations.

In South Africa, pressure on the prepaid market is anticipated to remain in the final quarter of the year, while the base effects impact growth in the wholesale segment.

With this in mind, MTN SA said that it will consolidate the gains from its network resilience plan and the ongoing implementation of new commercial initiatives, price optimisations and CVM to improve customer engagement.

“Post the period end, MTN SA made the outstanding payment of R1.9 billion for low-band spectrum acquired in 2022. MTN SA is well positioned to continue its trajectory of steady top-line growth and EBITDA margin improvement, which support an improving cash flow generation and return profile.”

“We continue with focus on our strategic priorities of exiting selected markets in our current portfolio, completing the minority investment in Group Fintech with Mastercard, and liability management of Holdco debt,” Mupita said.

“The Group board continue to anticipate paying a minimum ordinary dividend for FY2023 of 330cps”.

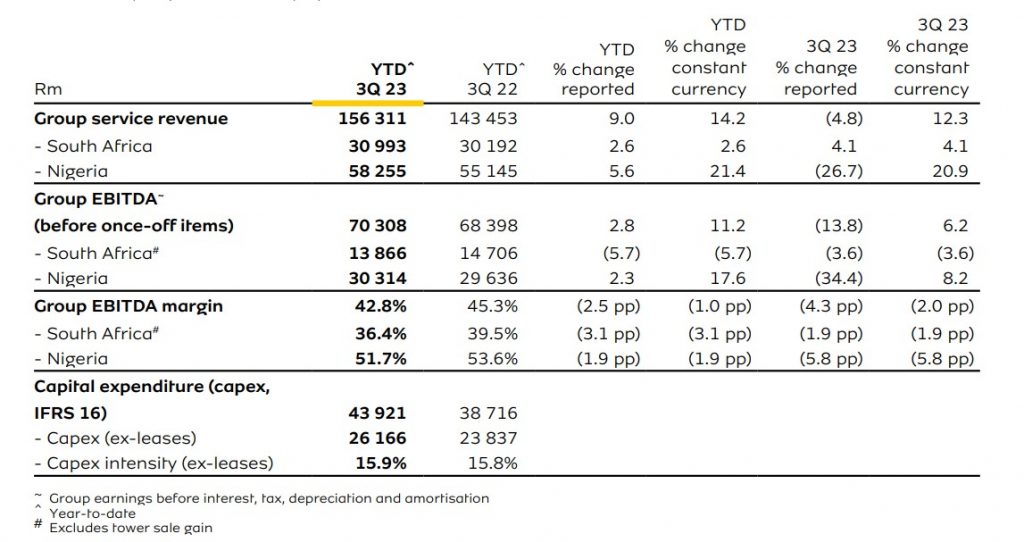

Below are several key financials from MTN’s Q3 update:

- Group service revenue grew by 9.0% (14.2%)

- voice revenue declined by 0.6% (up 4.3%)

- data revenue growth of 15.3% (23.1%)

- Fintech revenue growth of 20.0% (22.1%)

- Total subscribers increased by 1.8% to 290.1 million

- Active data subscribers up by 6.7% to 144.6 million

- Active Mobile Money (MoMo) monthly active users (MAU) up by 0.7% to 63.5 million

- Data traffic increased by 20.1% to 10 612 PB

- Fintech transaction volumes increased by 33.9% to 12.7 billion