South Africans can’t afford their homes

Distressed house sales are on the rise as consumers cannot keep up with rising interest rates.

According to Lightstone, the number of homeowners who sold their properties within two years of purchase grew from 2% of sales in May 2022 to 3.7% a year later.

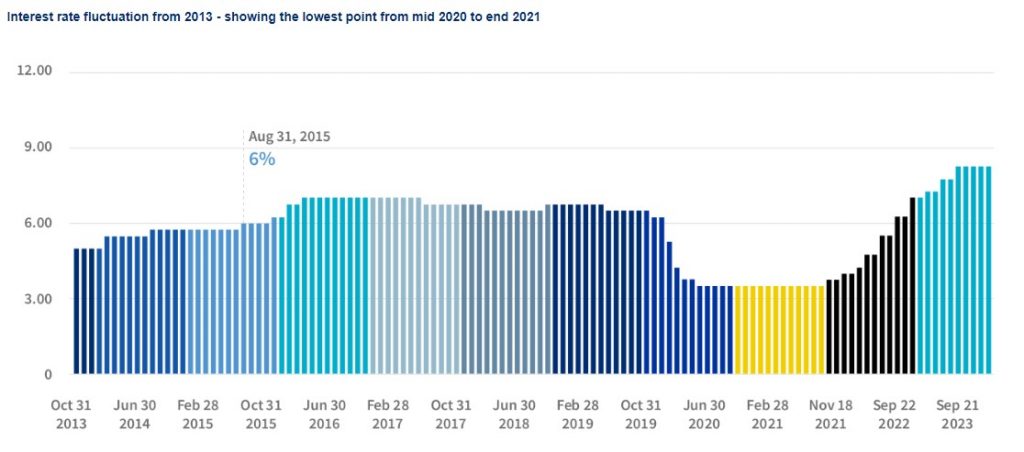

“This suggests that many buyers took advantage of the low-interest rates as the market provided relief during Covid, only to find they could not afford mortgage repayments as interest rates normalised,” Lightstone said.

“In days gone by, distressed sales were easier to measure as bank repossessions were sold on auction and the market was alerted by Sales in Execution (SIE) notices published in the Government Gazette.”

“Today, banks try to avoid the SIE route and have put alternative processes in place to assist owners to sell their properties when they need to, in an effort to avoid big losses for both the homeowners and the bank.”

To see if distressed sales are rising or not, Lightstone looked at the property sales volumes, the number of properties bonded and the number of sales within two years of purchases.

Low interest rates in 2020 and 2021 allowed new buyers to enter the market or allowed existing buyers to buy up. However, this also resulted in many buyers overstretching their finances.

The volume of residential purchases by natural persons (excluding companies and trusts) dropped by 50% from May 2022 to May 2023.

In addition, the number of buyers who bonded their properties dropped from 60% in May 2022 to 40% in May 2023.

This means that there were less buyers in the market, and even those who did buy were less likely to bond their purchase.

For example, there would have been 60 bonds for 100 sales in May 2022, but there were just 20 bonds for 50 sales in May 2023.

With volumes and bonds down, Lightstone also noted that there has been an increase in distressed sales between May 2022 and May 2023.

Lightstone said that 80% or more of those who bought in the middle of the low-interest period – May 2021 – were sellers by May 2023.

“The example illustrates how an “event” like the low interest cycle, led to a problem emerging which was only visible later, when those struggling to pay bonds had sold and the data had fed into the Deeds Office numbers,” Lightstone said.

Read: This is how much South Africans spend on movies, video games, streaming services and more