South African fintech on a hiring spree as it targets tap-on-phone payments

Listed financial technology and payment specialist firm Capital Appreciation says the long-term trend towards digitalisation continues to fuel growth in the sectors in which it operates.

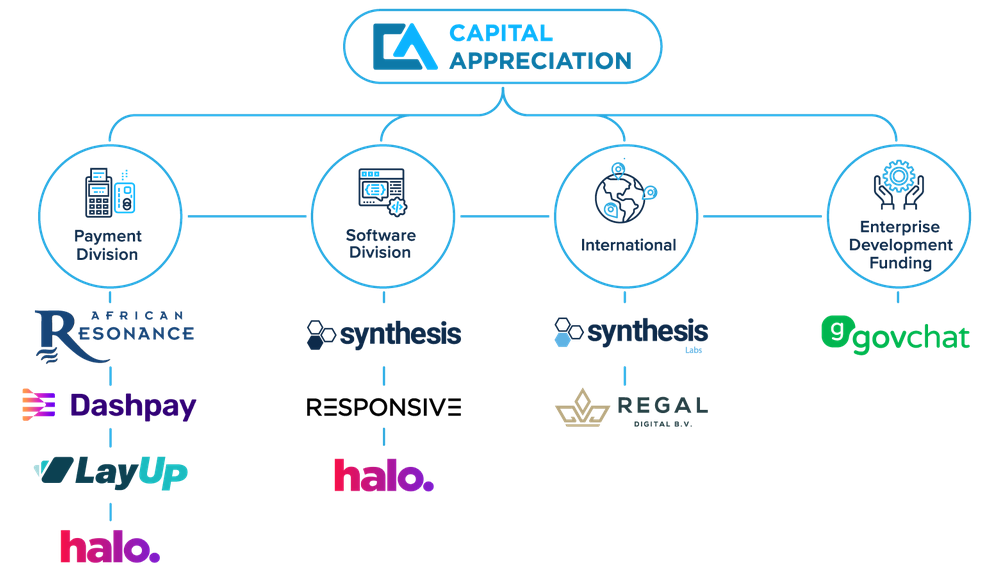

Capital Appreciation was listed on the main board of the JSE in 2015 and raised R1 billion through a private placement of shares. Having acquired 100% of African Resonance, Dashpay and Synthesis Software Technologies in 2017, it migrated to the Software and Computer Services sector on the JSE.

The group said in a company update for the five months since its March 2022 financial year-end that “demand for the adoption of electronic payments, cost-saving software solutions and cloud services have served to maintain the positive momentum in the technology sectors in which we operate, despite the acknowledged economic challenges being experienced both globally and in South Africa”.

The group stressed that while it is not immune to the consequences of the economic challenges, the positive trajectory of demand for its products presents opportunities for growth and expansion.

Capital Appreciation is operational in 20 countries, with offices in South Africa and the Netherlands, and employs 427 people.

“The demand from local and international customers for the products and services in the software division has continued in the past five months, leading to notable growth in service and consulting fees and sales of state-of-the-art Hardware Security Modules (HSM),” it said.

HSMs are used for enterprise encryption and to protect Payment Card PINs and contactless payments.

“Demand for cloud and digital services continues to grow, and the areas of intelligent data and managed services are showing strong progress,” Capital Appreciation said.

It said that in anticipation of strong growth, the software division has increased its headcount by 50% year-on-year, which includes a substantial intake of recently qualified graduates.

“The division has also materially increased its marketing and business development spend, particularly on its tap-on-phone Halo Dot initiative, which continues to make good progress and is achieving notable interest both in South Africa and internationally.”

The group said that demand for point-of-sale (POS) terminals continues to be robust, particularly as its addressable market increases. Economic challenges as well as the increasing preference for the additional functionality of the Android devices at lower price points are gradually shifting the terminal sales mix in favour of these terminals, it said.

The fintech said that the replacement lifecycle of terminals is also gradually becoming shorter as financial institutions and corporate customers replace their ageing terminal estates sooner to take advantage of improvements in technology, more functionally-rich solutions and to comply with international card specifications and certifications.

“These trends all point to consistent demand for POS terminals over the medium term.”

In June, the company reported a 34% increase in revenue R831 million for the financial year ended March 2022, benefiting from large terminal orders and terminal transaction income growth, as well as significant increases in cloud-based and digital consulting revenue and third-party software and hardware sales.

Headline earnings per share increased by 30% to 13.40 cents and dividends by 36% to 7.50 cents per ordinary share.

The group intends to release its interim results for the six months ended 30 September 2022 on or about 29 November 2022.

Read: Amazon opens new offices in Joburg – and it is hiring for these jobs