Alarm bells for South Africa’s GDP

Following two quarters of growth in 2023, recent manufacturing and mining data paints a worrying picture for the Q3 GDP print.

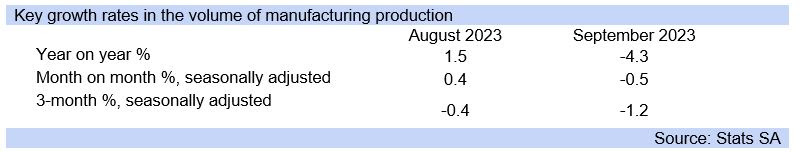

According to Stats SA, manufacturing production dropped from +1.5% y/y in August to -4.3% y/y in September – far lower than the Bloomberg consensus of -2.5% y/y.

On a quarterly seasonally adjusted basis, manufacturing output dropped by -1.2% and will thus detract from the overall Q3 GDP reading.

“Along with most other sectors of the economy, conditions in the manufacturing sector remain lacklustre,” Investec Economist Lara Hodes said.

Load shedding and logistics constraints are seriously impacting the sector, while the subdued global manufacturing environment also continues to dampen export potential.

“Global manufacturing started the final quarter of the year on a weak footing. Output contracted for the fifth month running in October, reflecting a further deterioration in new orders,” said the latest JP Morgan Global Manufacturing PMI survey.

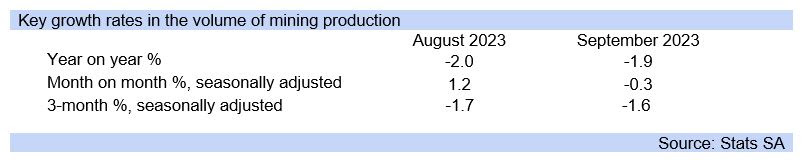

Mining production, on the other hand, recorded a -1.9 % y/y decline in September following a -2.0 y/y drop in August. This was slightly better than the Bloomberg consensus of a -2.4% y/y drop.

However, on a quarterly seasonally adjusted basis, activity dropped by -1.6%, meaning that the mining and quarrying sector will also detract from the Q3 GDP outcome.

“The fragile global environment, especially the subdued manufacturing sector, has weighed heavily on commodity demand, with the World Bank’s metals and minerals index down over -13.0% YTD (to end October),” Hodes said.

Diamond sales specifically have been hard hit, down -61.4% y/y in September, with the slower-than-expected rebound in demand in China impacting sales.

“Tax proceeds from the mining sector remain a significant source of revenue for the fiscus,” Hodes said.

The significant decline in tax revenues compared to projections was highlighted by Finance Minister Enoch Godongwana in the Medium Term Budget Policy Statement (MTBPS).

The Minerals Council of South Africa said that this was due to strain on profitability on the mining sector due to rising input costs, lower commodity prices, declining production and decreasing sales.

“While the decline in commodity prices is largely influenced by global factors outside our control, costs can be significantly reduced, and operational efficiencies improved by urgently resolving the electricity supply and logistics crises in the country,” Hodes concluded.