Warning over Eskom debt bailout – new rules, new problems

The Financial and Fiscal Commission (FFC) for South Africa is raising red flags over changes to the government’s takeover of Eskom debt, saying that there are doubts that the ailing power utility will be able to fulfil its end of the deal.

Delivering its response to the Medium-term Budget Policy Statement (MTBPS) presented by finance minister Enoch Godongwana on Wednesday (1 November), the FFC generally welcomed the National Treasury’s moves to rein in demand from failing state companies on the budget.

In his MTBPS, the finance minister outright rejected calls from SOEs like Transnet for multi-billion rand bailouts, and went even further by making the conditions for the already-agreed-upon debt-takeover for Eskom even tougher.

Amidst the utility’s dire financial performance, Godongwana announced in the February Budget that R254 billion would be given to Eskom as debt relief over the medium term.

This was done to ease pressure on the company’s balance sheet and free it to invest in transmission and distribution infrastructure.

This debt was given strict conditions to ensure public funds were used appropriately. A key caveat attached to the deal is that the loan would not be converted to equity if Eskom violated the conditions.

In the MTBPS, Godongwana tabled the Eskom Debt Relief Amendment Bill, which improves the enforceability of the conditions as part of the debt relief agreement.

Crucially, it provides for the payment of interest by Eskom on amounts advanced as part of the debt relief loan, and reduces the amount of debt relief available in the event that the entity does not comply with the National Treasury conditions.

The FFC has warned, however, that these stricter conditions – and making Eskom pay interest on the loan – may cause complications.

“The conversion of the Eskom debt relief programme to an interest-bearing loan means that Eskom will be obligated to pay interest in addition to repaying the principal amount.

“The impact that this will have on the fiscus will depend on the interest rate specified in the loan agreement, as well as Eskom’s ability to service interest payments on the loan.

“Without significant structural reforms that address the root causes of its financial and operational challenges, it is unlikely that the entity will be able to serve these debt obligations,” the FFC noted.

The group also warned that this was a problem around SOEs in general.

Government guarantees have been increasing while the financial performance of SOEs has been deteriorating, resulting in an unhealthy virtuous cycle whereby SOEs depend heavily on the fiscus to sustain their operations.

Over the past decade there has been a significant decline in the performance of major SOEs amidst increasing operational costs, falling net profits and increasingly unsustainable debt levels.

“While it is encouraging that some efforts are being made to contain government guarantees over the medium term, the commission is of the view that such guarantees should only be granted to SOEs subject to an in-depth and explicit appraisal of their ability to service their debt obligations,” it said.

What makes Eskom a particularly egregious worry, though, is the fact that the utility accounts for 85.5% of liabilities attached to government guarantees to SOEs. Though the debt relief this is expected to decline to 53.4% by 2025/26, this is only if Eskom can fulfil its end of the deal.

“The Minister of Finance has not yet clarified what the Eskom debt relief conditions conditions are. Historically, debt bailouts to SOEs have continuously failed to address the underlying structural issues that lead to their poor performance, raising doubts as to whether the debt relief will improve its operational performance over the long term.”

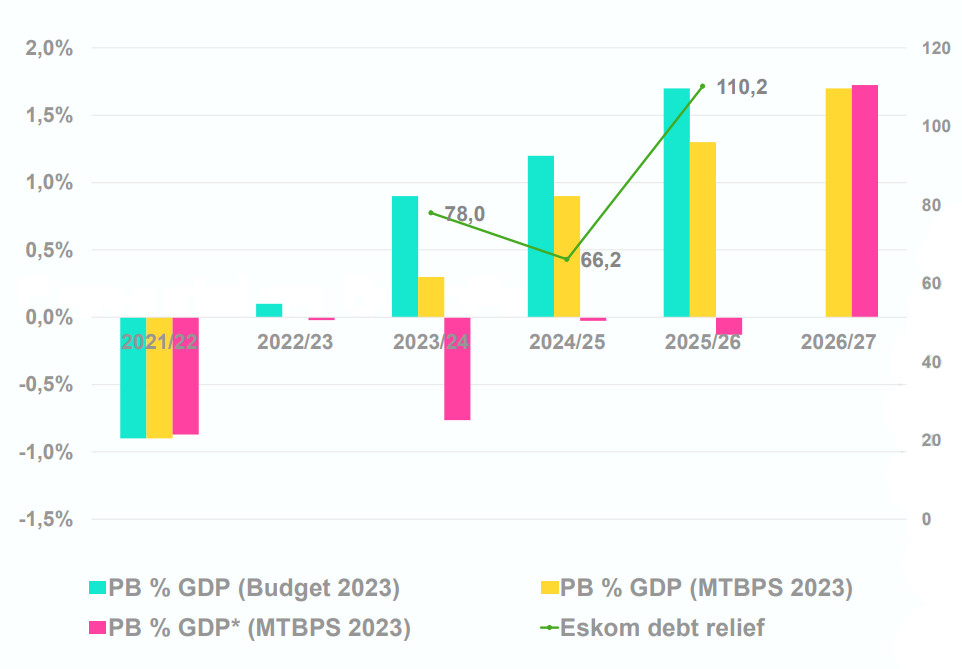

The impact of the debt relief on the budget is evident. Accounting for the R78 billion given to Eskom in the 2023/24 financial year brings the country’s primary deficit to 0.8% of GDP. With another R66 billion due in 2024/25 and R110 billion in 2025/26, the FFC said that a surplus is only expected in 2026/27.

“This means that the government’s ability to direct more funds towards stabilising its debt is significantly curtailed over the medium term,” it said.