South Africa readies for a rough landing

Economic data for the third quarter of the year is not looking positive, say economists at the Bureau for Economic Research (BER), with indications pointing to a significant slowdown in growth – if not stagnating altogether.

“Last week’s two domestic production data releases firmed up our view that South Africa’s economic growth slowed materially, if not stagnated, in Q3,” the BER said.

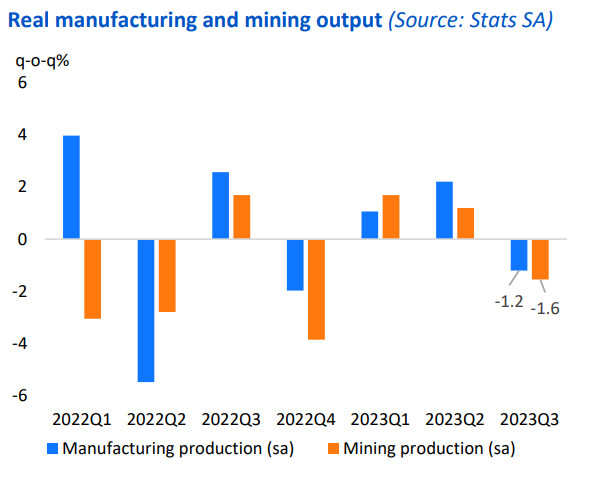

“High-frequency mining and manufacturing data both show a quarterly contraction in production relative to Q2.”

This is despite load-shedding being somewhat less intense in Q3 – indeed, electricity production rose by 0.7% q-o-q in Q3, following a 1.2% contraction in Q2, the BER noted.

According to Stats SA, manufacturing production plunged by 4.3% y-o-y in September, following a downwardly revised 1.5% increase in August.

While a worsening in the Absa PMI foreshadowed the decline in September, it was more pronounced than market expectations for a 2.6% y-o-y contraction.

Seven out of the ten main subsectors contracted, with the most significant drag coming from the production of food and beverages (-10.5% and shaving off – 2.6% pts) and motor vehicles (-19.7%; -2.3% pts).

Moreover, seasonally adjusted (as) manufacturing production fell by 0.5% m-o-m in September, compared to a 0.4% m-o-m increase in August.

Together with the notable monthly contraction recorded in July, this resulted in real manufacturing production falling by 1.2% q-o-q in Q3.

As such, the sector is set to subtract from quarterly real GDP growth in Q3.

“Unfortunately, the October Absa PMI suggests the sector also experienced a tough start to Q4,” the BER said.

Regarding mining sector activity, production declined by 1.9% y-o-y in September, slightly better than expected, and marginally improved from an upwardly revised 2% y-o-y drop in August.

The biggest drag on annual growth stemmed from the production of diamonds (down by 61.4% and shaving off 2.9% pts), followed by ‘other’ metallic minerals (-17.1%; -0.5% pts) and manganese ore (-5.6%; -0.4% pts).

The negative impact was countered somewhat by decent growth in iron ore production (+8.5% y-o-y, +1.0% pts).

On a monthly (sa) basis, however, mining production fell by 0.3% m-o-m in September following the 1.2% rise in August.

“Alongside the poor performance in both July and August, this contributed to a 1.6% q-o-q contraction in mining output in Q3. As with manufacturing, the mining sector is also likely to weigh on quarterly real GDP growth,” the BER said.

According to economists at Nedbank, the poor performance comes as no surprise, given little to no improvement on the logistical front and only mild improvements in energy availability over the month.

“Lower commodity prices in a more subdued global economy also hurt mineral sales, which fell, in nominal terms,” it said.